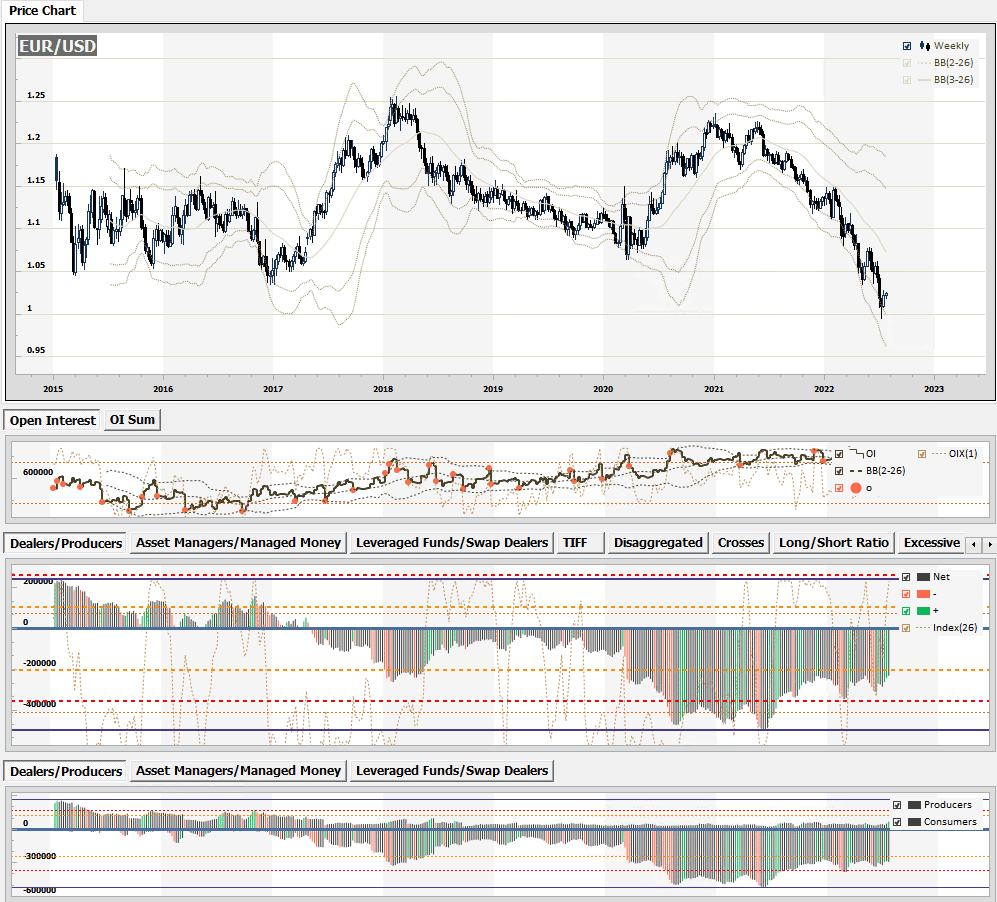

The Commodity Futures Trading Commission publishes the Commitments of Traders (COT) reports helping the public understand market dynamics, specifically, the COT reports provide a breakdown of each Tuesday’s open interest for futures and options markets. While most market followers look at charts, you will be looking at the actual condition that affects price change: large buying and selling, true supply/demand pressure that will be able to be seen each week as the billion-dollar successful traders and pools enter the marketplace.

The COT reports provide a breakdown of each Tuesday’s open interest for futures and options on futures markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. The Commitments of Traders (CoT) Software is based on the REAL positioning of market movers; you can follow the supply and demand imbalances and assess the momentum in the markets.

How to Register the Product?

This is one of our vendor's products and not a ClickAlgo product, so the registration process is different, when you purchase this product you may need to wait up to 24 hours for it to be activated as this has to be done manually.

CoT Reports

The COT reports are based on position data supplied by reporting firms (FCMs, clearing members, foreign brokers and exchanges). While the position data is supplied by reporting firms, the actual trader category or classification is based on the predominant business purpose self-reported by traders on the CFTC Form 40 and is subject to review by CFTC staff for reasonableness.

Generally, the data in the COT reports is from Tuesday and released Friday. The CFTC receives the data from the reporting firms on Wednesday morning and then corrects and verifies the data for release by Friday afternoon.

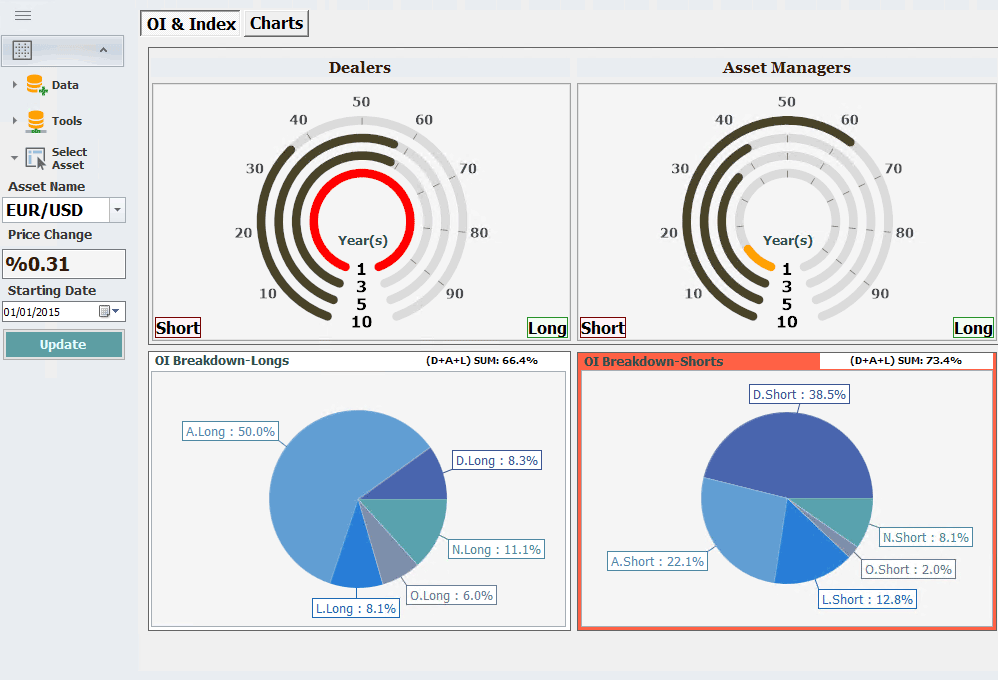

COT indicators identify the level of bullishness and bearishness for every trader type along with movements which most of the time signals the end of pullbacks.

Legacy

- Commercials

- Non-Commercials

TIFF

The Traders in Financial Futures (TFF) report includes financial contracts, such as currencies, US Treasury securities, Eurodollars, stocks, VIX and Bloomberg commodity index,

- Dealers

- Asset Managers

- Leveraged Funds

Disaggregated

The Disaggregated reports are broken down by agriculture, petroleum and products, natural gas and products, electricity and metals and other physical contracts.

You can consider COT as legal insider information. Who knows fundamentals better than those who produce a commodity/currency or those who consume it?

By using the COT report, you can see the flow of money and true sentiment in the market which is based on the real positioning of large players. Combine COT with a reasonable timing tool such as price action and you have a reliable strategy.

What is the CoT Index?

The cTrader COT index is a technique used to quickly quantify the actions of a group of traders which allows us to put into perspective the weekly positions of these commercial traders to have a constant reference point by which to judge their actions very quickly and how their current level of buying and selling compares to any previous time in the past 3 years.

Watch a Video Demonstration

Watch a video overview showing the key benefits of using this software package for Windows.

Duration: 6-minutes - Watch full screen on YouTube

Your API Keys

COT index automatically connects to the Quandl website to get COT data. The user needs to subscribe at Quandl and gets a free API key.

You can find instructions on how to get a free API key at https://docs.data.nasdaq.com/docs/getting-started

How to Use

The first step is to get familiar with this software and how it can help your trading, there is a user guide that explains all the data you see and you can also follow the links below for additional educational material.

Any Questions?

If you have any questions, please first search our product help forum for the answer, if you cannot find it, post a new question.