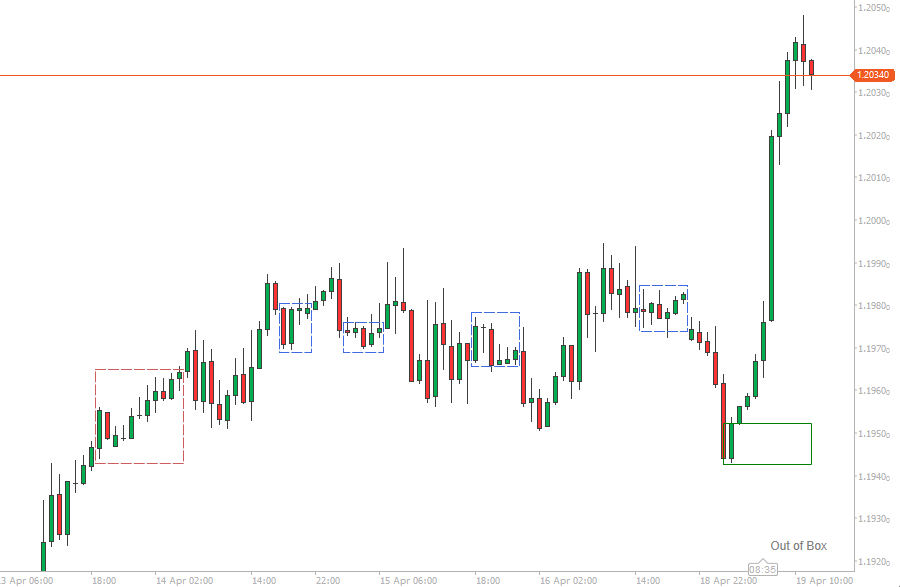

Detecting sideways movement can help the trader secure profits, cut losses or place limit orders in his favour. These are a few ways that we can use a box:

Detect consolidation areas

For past boxes that contain several bars inside them, we can safely assume that these are consolidation areas and that we have a sideways movement. These areas can serve as support or resistance levels in your analysis of the price action.

Place your trades better

In case you have a setup for a trade and you see the price boxing, you can always use the box as a guideline for the price action, to get a more beneficial position for your trade. The box that is currently forming can be used either to secure some profits in a winning position, re-enter a trending market or place stop losses.

Place limit orders

The long sideways movement will eventually lead to breakouts. Boxify can help you place limit orders, above or below, to get the most out of a breakout start.

Indicator options

The indicator will attempt to box the price from at least 2 bars and above. Messages from the indicator will appear in the bottom right corner of the chart area.

- If the price is trending, the message “Out of Box” will appear.

- If the price is boxing, the message “Boxing” will appear.

- If the price is boxing and the price breaks the upper limit, “Breaking High” will appear.

- If the price is boxing and the price breaks the lower limit, “Breaking Low” will appear.

Boxes are considered complete at a new bar opening, as the price can always retract back into the box.

Minimum Bars for Box

This number represents the minimum number of bars that a box has to have to be considered complete. Use lower numbers for entry points, and higher numbers for consolidation areas.

ATR Filter

Boxify has internally an ATR indicator, that you can use as a filtering option, in case you want to stop the box formation on any bar that its length (High-Low) breaks the ATR value. Use this option if you want to enter trades.

Merge Overlaps

The beginning of a box can start before the previous box has ended (especially if we have selected a very low number for box length). We can merge these boxes with this option, so we can see a bigger box forming – These boxes will have a blue-coloured border.

Tolerance

A number that reflects the tolerance that the top/bottom limits of the boxes can have. Small numbers should be used when we want to enter trades, bigger numbers should be used when we want to find consolidation areas.

How To Install & Remove

First, make sure you have the cTrader trading platform installed and then unzip the file and double-click on it to automatically install it onto the platform.

Any Questions?

If you have any questions, please first search our product help forum for the answer, and if you cannot find it, post a new question.

Need a Broker

If you are still looking for a broker you can trust, take a look at our best cTrader broker site.

Need Coding Help?

If you need help creating your very own customised automated trading system, contact our development team for a quote.