When you use trailing stops with price action you determine when to exit the market and the purpose of moving the stop is to reduce risk and increase your profits.

Advantages

Risk Management is one of the most important aspects of trading and having a Stop Loss will protect you from margin calls and big losses, in many cases, it is useful to have a trailing stop, which is also called a moving stop, this is where the stop is updated when the price moves in favour of the trade locking in profits and reducing any risk exposure.

There are several advantages of using cTrader Candle High, Candle Low Trailing Stop cBot:

- A Stop Loss is set automatically if there is none.

- Manage both buy and sell orders at the same time.

- Better Order Placement by measuring volatility.

- The Stop Loss follows the price when moving in the favor of the trade

- It doesn’t require human interaction.

- Limit Losses.

- Secure Profits.

- Avoid Margin Calls.

How to Use This cBot

The first step is to understand the settings that you will need to adjust, these are explained below, once you have your preferred setup all you need to do is start the cBot and it will manage both existing trades that are open and any new trades that you may open after you start this system.

This technique uses a set amount of closed candles in the direction of the trade to determine where to move the stop loss.

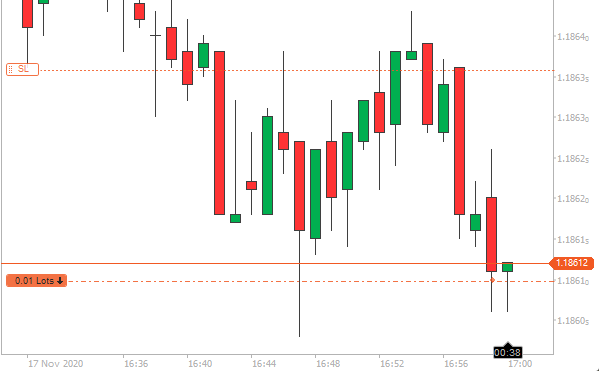

Example Sell Trade

The picture below shows a short trade using the Candle High-Low Trailing Stop System to adjust the stop loss on the High price of the 3rd candle in the past, this uses the setting of 3 bars back. When the current candle closes the stop loss will be re-adjusted to the new 3rd candle back which will be the highest value out of the last 3 candles and it continues to do this locking in profits until the price hits the stop loss.

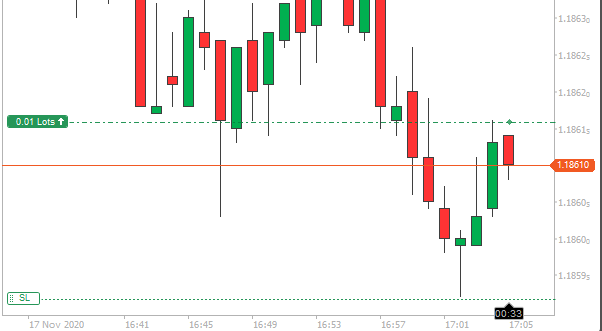

Example Buy Trade

The picture below shows a short trade using the Candle High-Low Trailing Stop System to adjust the stop loss on the Low price of the 3rd candle in the past, this uses the setting of 3 bars back. When the current candle closes the stop loss will be re-adjusted to the new 3rd candle back which will be the lowest value out of the last 3 candles and it continues to do this locking in profits until the price hits the stop loss.

What Do The Extra Pips Do?

The setting for extra pips allows the stop loss to be set above or below the high or low of the previous candles price, so instead of setting a stop loss on the lowest price of a candle for a buy trade, if you set the extra pips to 5 it will set the stop loss 5 pips lower.

Which Symbols Does It Manage?

Due to the fact that the Candle High-Low indicator is calculated for the symbol that you have selected when you create a new cBot instance than it will only adjust the stop loss for that particular symbol, it will not manage all open symbols, if you wish to use this tool on another symbol, you will need to create a new cBot instance and configure again.

Positions With No Stop Loss

If you have any positions with no stop loss, then this tool will automatically create a stop loss that will trail behind the symbol price based on the previous candle's high and low calculations.

Positions With A Stop Losses

If you have any positions open that have an existing stop loss then this will be replaced by this tool and the new stop loss will also trail behind the price based on the previous candle high and low calculations.

Does It Manage The Take Profit?

No, this tool will only manage your stop loss but will move the stop loss in profit so that it acts as a take profit.

Managing Only Trades Opened by an Automated Trading System

It is possible to manage only trades opened by an automated trading system for a symbol, to use this feature you need to set the Attach to the label setting to YES and enter the label name that has to be the same as the label name in the automated cBot.

With a custom, cBot set the label name to be the same as the label name in this tool so that it can manage the stop loss. If you set the Attach to the label to NO then it will manage all trades for the symbol both manual and automated.

Candle High-Low cBot Settings

- Attach to Label - option to only manage positions that have a unique label name.

- Label Name - the unique label name of the position.

- Last (x) Candles - how many candles back are used for the high or low calculation?

- Additional Pips - how many extra pips are used above or below the candle price?

Watch a Video Explainer

We have recorded a hands-on tutorial on how to use the cBot.

Duration: 12-minutes - Watch full screen on YouTube

How To Install & Remove

First, make sure you have the cTrader trading platform installed and then unzip the file and double-click on it to automatically install it onto the platform.

Any Questions?

If you have any questions, please first search our product help forum for the answer, and if you cannot find it, post a new question.

Need a Broker

If you are still looking for a broker you can trust, take a look at our best cTrader broker site.

Need Coding Help?

If you need help creating your very own customised automated trading system, contact our development team for a quote.