The cTrader Volatility Trading Terminal has five separate configuration sections to allow the user to maximise profits and reduce the risk of any open positions caught out in extreme price moves.

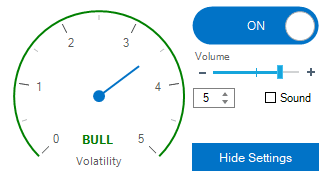

Symbol Volatility Meter

This meter shows the user visually the current volatility of a symbol on a 1-minute timeframe in pips, it calculates the speed and length of a body being created, this identifies if there are large price moves, there are settings which will allow the user to set to capture short or long rapid price moves.

The gauge will automatically increase when the value of the volatility exceeds the maximum value, in the picture above, the maximum value is 5 which is the number of pips moved, the drop-down box on the right which also shows 5 allows the user to manually adjust the gauge to suit the symbol as some symbols will need a maximum value of 100, Forex has a low spread so the number 5 is adequate.

Audible Sound Alert

The audible sound alert is very useful when the trader is looking at a different chart or away from their computer, the sound level can be adjusted by sliding the bar left and right and the sound can be enabled or disabled by clicking on the checkbox.

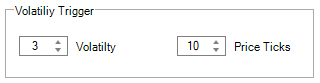

Volatility Trigger

The volatility panel settings allow the user to set the sensitivity of the meter, this value will differ from symbol to symbol, so for EURUSD which has a small spread and pip size, the following settings are guidelines. You will find that with symbols with a higher spread and pip size the values for the trigger will be higher, you will need to experiment and find the correct settings for low, medium and high volatile market conditions.

Example of EURUSD

- 3, Small price movements, active market.

- 5-10, Very active markets, possible medium news events.

- 10+, Extremely active markets, major news events or other market events.

Price Ticks - Trend Determination

The price ticks value calculates the trend direction the higher the value the stronger the direction, and the lower the weaker the direction, if you have the value too high you may be alerted towards the end of a price move and if you set it too low it may be too soon and not a string price movement.

Example

The price tick value is set to 10, which means for the last 10 price updates (ticks of data) for a bullish signal, each previous data value must be less than the current value.

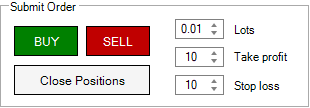

Manual Trading (Scalping)

It is possible to scalp using this tool by configuring the settings for small solid price movements and be informed of the trend direction and when this happens the controls below can be used to quickly enter a market order with a preset position size, stop loss and take profit.

it is also possible to close all positions that were opened by this terminal for the given symbol, this will not close any other manual or automated symbols that have been submitted.

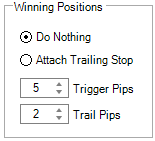

Lock-In Your Profits

All open positions can be managed by this software when there is high volatility that is captured by this software. Only winning positions that are of the same trend as the volatility meter will be managed, if there is bullish volatility and there are bearish open winning positions then these will not be managed as they are in the opposite direction of the price surge.

- Bullish trend - buy positions in profit and chase the price.

- Bearish trend - sell positions in profit chase the price.

The trailing stop used is a standard feature where it is activated when the price reaches the trigger value in pips and then as the price continues it trails (x) pips behind the price until a retracement reverses the price and closes the position locking in maximum profits.

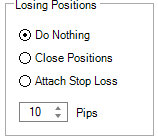

Minimize your Losses

This is one of the most useful features of the volatility trader, it will protect your exposed positions due to high-impact market events that can cause the price of a symbol to move in an unpredictable direction very quickly and if there are any positions with no stop losses it can also blow the entire account balance.

- Bullish trend - sell positions losing will close or a stop loss is attached.

- Bearish trend - buy positions losing will close or a stop loss is attached.

There are 3 options, do nothing, close all open positions for this symbol and attach a stop loss. Only positions that are in a net financial loss that are in the opposite direction to the trend surge will close, all positions that are losing, but in the same direction of the trend will continue to run and eventually be activated by the winning trailing stop feature explained above.