Please note that each symbol you wish to trade will require different parameter settings and when you have chosen the symbol you would like to use then your next step is to adjust the cBot settings to achieve your desired results, this is often done using the cTraders optimisation module. Important Settings are highlighted in red.

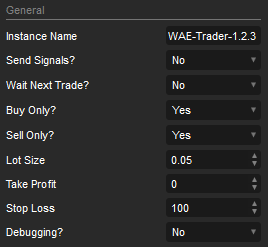

General Settings

The general settings for the trading system will consist of the symbol & timeframe that you wish to trade with, the adjustable settings are shown together with explanations.

Instance Name

This setting will allow you to run the same multiple symbol instances with different parameter settings at the same time independently, it is also the name used in the label shown in the history tab so you can filter all your automated trading systems and only show trades for this product.

Send Signals

This is the master switch to turn on or off the Telegram and Email notifications when there is a signal for entering a trade.

Wait for Next Trade

If this is set to YES then when the robot is first started the first signal to open a trade is ignored, it will wait until the next trade signal, this is to prevent a trade opening when the robot first starts at the end of a trading cycle.

Buy & Sell Only

If you choose No, the robot will exclude all trades in the direction specified, having them both set to Yes, will allow the robot to open both Long & Short trades.

Lot Size

The position size in Lots for all new trades that are submitted to open.

Take Profit & Stop Loss

This is where you specify your fixed stop loss and take profit values in pips, this type of trading system benefits from advanced risk and profit management, so you may leave these set to zero (0) which disables this feature, but you have the option to set fixed values.

Debugging

As this is a community project you can turn debugging on so that you can check if the entry and exit signals are correct, which this feature turned on you can also see a vertical line placed on the chart when there is a trade signal.

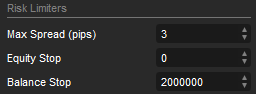

Risk Limiters

This controls your account protection against losing all your money while you are not watching your trades.

Max Spread (pips)

This is the maximum spread allowed for a symbol before the robot stops opening positions, this is very useful if you have a small grid distance value and when the spread is very high due to low liquidity.

Equity Stop

This feature is very useful to prevent you from blowing your account if the system starts to lose too much, you set the value to the amount that you want the robot to stop and close all positions when your account equity including all open losing positions drops to the value you have set.

- Equity stop set at 500, as soon as your account equity reaches or drops below 500, the robot will stop and all open positions will close. The account equity includes all open trades in negative or positive balance.

Balance Stop

This will stop the robot and close all open positions when your account balance drops below the value you have set, it is very useful to help prevent losing your capital.

- Balance stop set at 1000, as soon as the balance of your account is below or reaches 1000 then the robot stops and all open positions will close. There may be open positions that have a negative value that will cause a loss and the final balance to be lower than the pre-set balance stop value.

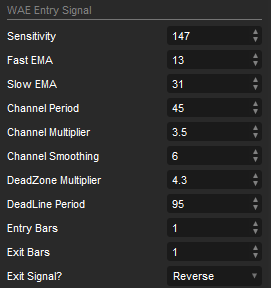

Waddah Attar Entry Signals

The core of this trading system is the Waddah Attar Explosion indicator and this is what is used for the targetted entry signals, the system also uses various trend indicators to determine the chosen timeframe trend.

Sensitivity

This relates to the explosion line value, the lower the number the less sensitive it is, the higher the number the more sensitive the explosion line is to change.

Fast & Slow EMA

These are the fast and slow Exponential Moving Average values that are used in the calculation for the WAE indicator.

Note:

The fast EMA period must be lower than the slow EMA period, if you set a fast period to a value higher than the slow period you will reverse the signals so a Bullish bat is actually showing a bearing bar.

Channel Period

How many bars or periods back does the indicator look for the calculation.

Channel Multiplier

A multiplication value used for the channel calculation.

Channel Smoothing

A smoothing value used for the channel calculation.

DeadZone Multiplier

A multiplication value used for the dead-zone calculation.

DeadZone Period

The is the value for the deadline, the higher the value the higher the deadline.

Entry Bars [1-5]

This is the number of bars allowed to enter a trade; if the value is set at 2 then there must be 2 WAE same side-bars above the explosion line for a trade signal to open a position.

Exit Bars [1-5]

This is the number of bars allowed to exit a trade; if the value is set at 2 then there must be 2 WAE same side-bars above the explosion line for a trade signal to close a position.

Exit Signal

This setting allows positions to close when the reverse signal occurs with the WAE indicator or when the same sidebar drops below the explosion line.

- None - trades are not closed using the WAE explosion indicator.

- Standard - this uses the recommended method to close trades by Waddah Attar which is when the same side-bar drops below the explosion line.

- Reverse - this is when there is an opposite signal to buy or sell from the WAE indicator. This method provides the best results.

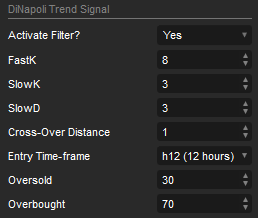

DiNapoli Stochastic Indicator

This is a very special indicator that is used with some of our premier products and has proven itself over the years, in our opinion it is one of the best trend indicators due to its special calculation of identifying price reversals and fake price reversals.

Fast K, Slow K, Slow D

Cross-Over Distance

This is the distance between the signal and result line when the signal line crosses above or below the result line which identifies a trend reversal.

Entry Time-frame

This is the main entry timeframe for the indicator and it will signal bullish or bearish trend signals based on the timeframe.

Oversold

If the signal or result line drops below this value then the symbol is seen as oversold, so a sell trade will be blocked.

Overbought

If the signal or result line rises above this value then the symbol is seen as overbought, so a buy trade will be blocked.

Standard Trailing Stop Loss

A trailing stop is a useful feature to use, the take profit target will trigger when the position is gaining (x) pips and also trail behind the price by (x) pips, if the price retraces too far it closes the position and locks in your profit.

Trailing Stop Trigger

This the value in pips when the trailing stop is activated.

Trailing Stop Step

This is the value in pips that the take profit target will follow behind the symbol price.

News Event Manager

We have included this product for free to allow you to avoid trading during high impact news events, for more information on how to configure the NRM product, please follow the link below.

Telegram Notifications

In order for the software to send Telegram messages to your Telegram bot on your PC or mobile phone, you will need to find your Token and ChatID, we have created a detailed support page to help you create a telegram message bot account if you are new to the Telegram messaging service.

- What is Telegram Messaging?

- How to create your Telegram message bot account

- Read this Blog to Set-Up Your Telegram Bot

To send messages to a Telegram group just add a minus to the start of the ChatID, for example: -82798983

Bot Token

Enter your token here, you can find this by following the instructions above.

Chat ID

Enter your Chat ID here, you can find this by following the instructions above.