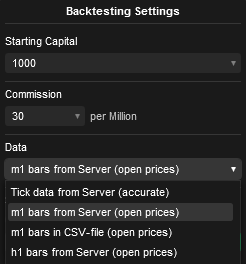

When you run a backtest using the cTrader trading platform you have options for the type of historical data you can use and each option will give you different results, so it is very important that you choose the correct one.

There are 4 options to choose, as shown above, we usually perform backtests with m1 bars from the server as this is the quickest, we shall now explain each option:

Tick data from Server

This method includes the historical spread of the symbol in each tick or price data or at each price change, using tick-data will produce more realistic market events, but as we will be using all the data each time the price changes which can happen many times per minute than this can take a very long time to backtest as it will use a huge amount of data as it also contains the history or the spread. A high specification machine is recommended for using tick-data with a high amount of RAM.

M1 bar from Server

This is the standard setting for backtesting and uses the prices only when a 1-minute candle closes, so an m1 bar is a 1-minute candle and when the candle closes after 1-minute the open-high-low-close (OHLC) prices are used in the backtest, if your trading system uses a timeframe above 1-minute than this data option should be ok, it may be worth noting that the symbol spread is fixed and selected in the backtest settings, it is well known the spread changes on each price change depending on liquidity, so this option is not really a true view of historical data.

M1-bars in CSV File

This option will allow you to load in data from an external source which can be in the 1-minute bar format only.

H1-bars from Server

This option is not often used but is the fastest method to backtest as it uses data only every 1-hour, this option could be used for a quick check to see if your trading system has potential.