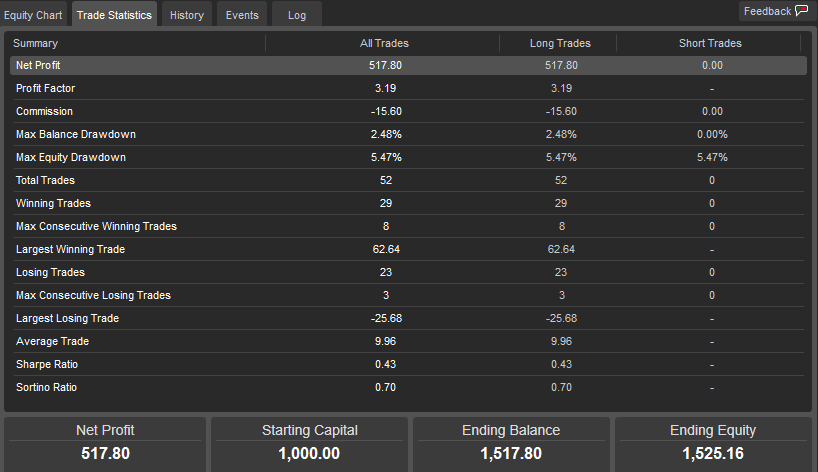

All the information for a backtest is displayed in the Trades Statistics tab where you can find the statistics on how your cBot performed and how much of your money was at risk.

Trade Statistics Overview

Many traders who run a backtest do not understand what the actual statistics mean and how to interpret them, below is a description of each one, and the most important statistics are highlighted.

Net Profit

This is the realised profit after all trades have closed, the Net profit would be the actual money you have won, but does not include any trades still running that would be at a loss. If your Net profit was £500 and you had a trade open with a loss of £50 and if you close this position your total net Profit would be £450.00

Profit Factor

This is a calculation of the ratio between the Total Net Profit divided by the Total Net Loss.

Commission

When using Forex most brokers charge a commission as well as the Bid/Ask spread to allow the trader to enter a trade, this value is the total amount of commission that was charged for all the trades that were executed.

Max Balance Drawdown

This value is very important as it shows how much of your original account balance was at risk as a percentage at any time during the trading dates of the backtest.

Max Equity Drawdown

This value is also very important as it shows how much of your account equity was at risk at any time as a percentage during the trading dates of the backtest.

The account equity takes into account all open positions that have not closed for both winners and losers. If your balance shows £1000.00 and your equity shows £500.00, this means that if you closed all your open positions your final balance will be just £500.00, this is because your open positions were losing 50% of your initial account balance at £500.00

A 50% equity drawdown means at some point the maximum risk of your total equity was 50%, so with £1000.00 equity, you would have been losing £500.00, this would be the same as a 50/50 gamble or a flick of a coin, we recommend a maximum drawdown of 5%

Total Trades

This shows the total number of both buy and sell trades that were submitted and closed during the backtest, this does not include existing open trades that have not closed.

Winning Trades

This is the total number of winning trades which have closed in profit.

Max Consecutive Winning Trades

This is the total number of winning trades that were closed one after the other with no losing trades.

Largest Winning Trade

During the backtest start and end dates, this will show the amount of the largest winning trade that closed at a profit.

Losing Trades

This is the total number of losing trades which have closed with a loss.

Max Consecutive Losing Trades

This is the total number of losing trades that were closed one after the other with no winning trades.

Largest Losing Trade

During the backtest start and end dates, this will show the amount of the largest losing trade that closed at a loss.

Average Trade

This will show the calculated average value of the profit or loss for all trades that closed.

Sharpe Ratio

The Sharpe ratio term is used by trading platforms as a measure of the Return of Investment (ROI) compared to the risk. The ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk.

Sortino Ratio

The Sortino ratio is an alternative to the Sharpe ratio which uses downward deviation in place of standard deviation.

Common Questions

Why is my ending equity different from my ending balance?

If you had an ending equity of £2000.00 with an ending balance of £1000.00, this means that when the backtest finished there were still open positions that had not yet closed worth £1000.

The same would have if you had open positions at a loss your ending equity would be less than your ending balance.