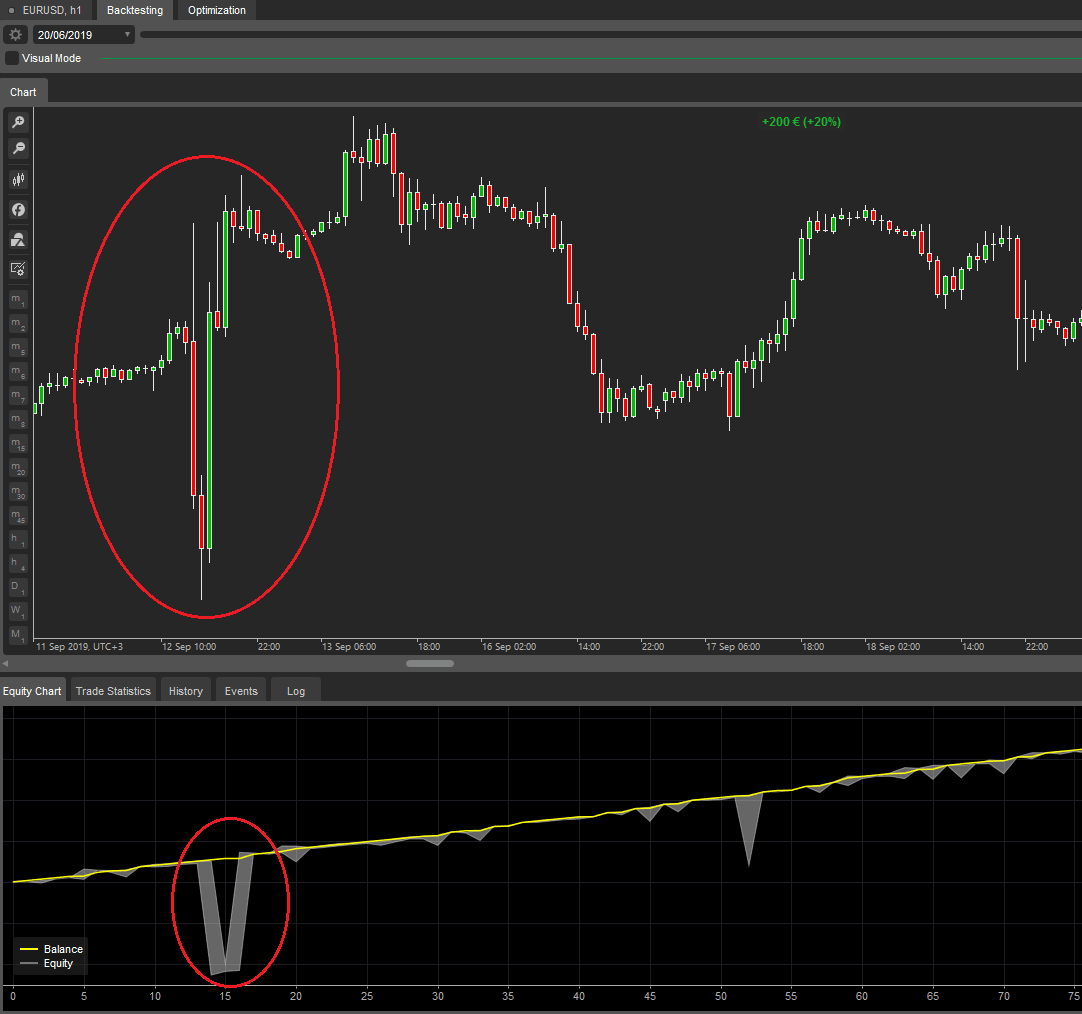

One of the biggest flaws backtesting a technical type of automated trading system using the cTrader trading platform that relies on indicators is that you cannot factor in market events like high impact news events. Your system may show flawless results until all of a sudden you see a big drawdown spike as shown below, this is usually caused by either a news event or other unpredictable market event. Unfortunately, we cannot filter out these news events when backtesting and even if your trading system uses a news manager to prevent positions opening during this period, we cannot show this in a backtest.

News Event Manager Integration

Many of our trading systems have a news manager integrated into them, this means that when they are trading they can automatically pause opening new positions and even close existing ones before the news event and also restart trading again a set time after the news is published when the markets have settled. By avoiding these market events the trading systems can also avoid potential losses or big drawdown spikes on their accounts and continue with low-risk trading.

- The image below shows a typical high-impact news event where the price moves first up to take out stop-losses and then 140-pips down to take out more positions before finally settling almost exactly where it started.

- This pattern you see below happens time and time again during these news events and new traders usually always lose and automated trading systems have their stops hit as many traders do not use a stop loss of 100 pips and above.

Covid-19 and Other World Events

Most of our trading systems also suffered from the recent market volatility caused by the recent Covid-19 pandemic, this type of event can be managed by the trader by simply turning off all automated trading systems and wait for the world to correct itself, remember that if you are using technical indicators to trade then the fundamentals of world events are very unpredictable and can easily cause your positions to lose money.

Our Tip

Watching out for market events that can affect your trades is very important, knowing when to turn off your trading systems and close positions and then wait until it is safe to trade again is as important as knowing when to enter a trade, it is fine to not trade for a long period of time, do not enter the market if you are bored.

News Release Manager cBot

We provide a news manager to use with our selected trading systems or to integrate into your own automated system using the API.