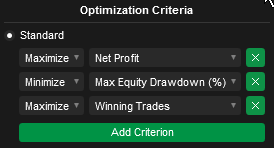

When you use the optimisation feature of the cTrader trading platform to find the best settings for your symbol over a certain date range, traders often overlook an important setting and that is the Maximise Winning Trades criteria built into the platform

By default, this is automatically selected by the platform when you run an optimisation and what the optimisation engine will do is try and do is try and get as many trades to open as possible, in our opinion more trades does not equal more profit and we have found that it actually increases the max drawdowns of the optimised settings. Unfortunately, new traders still feel that many trades should open in order to make a profit, this is far from the truth and it does not matter how many trades open in a month, the end result should be the highest profit with the lowest risk.

We optimised some settings for the Grid-Hedge trading system on EURUSD and found that with the settings above we get about 300-400 trades in a year, divide that by 12 and that's about 33 trades per month, but we also found it had the highest drawdown of equity of about 10% or the highest risk of money.

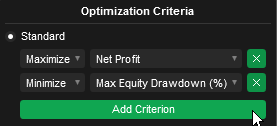

By removing the maximum winning trades criteria we had a much lower drawdown with the same net profit, the only issue that some new traders may have is that it does not open many trades per year in comparison to the settings with the maximum winning trades, the average total trades per year was about 100, which is about 8 trades per month, but we also found that the drawdown was much lower at 3-5% with the same net profit.

Conclusion

We suggest that you experiment with both settings to find settings that both return the number of trades you would like to see while at the same time keeping your risk to a level you are happy with, also, if you are a new trader, remember that more trades usually equals more risk, more commission and less profit (unless you are scalping), so run your backtests and let the automated trading systems run in the background for you, do not be emotional to want to see trades open or you will lose.