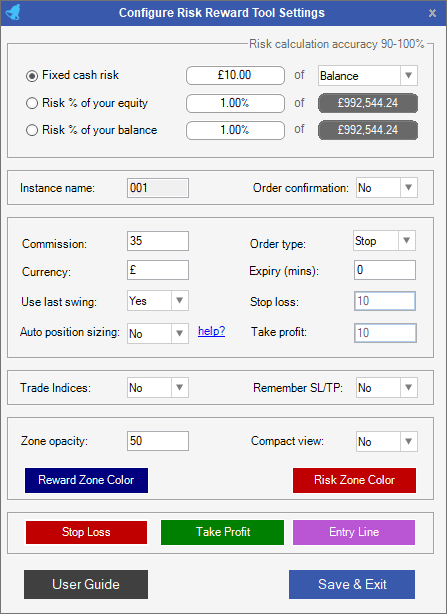

You have three options to choose from that will manage your risk, fixed cash, % of equity and % of balance, so that you will never lose more on a single trade than what you planned to lose before starting any trading. When you submit an order and then adjust the stop loss the Risk & Reward tool will continue to manage the risk of your open position.

The macOS version uses the standard cTrader parameters window instead of the panel shown below.

AUTO POSITION SIZING

The tool will automatically adjust your position size when you move the stop loss of an opened position or pending order, this is to maintain your original trade setup and risk vs reward ratio, you can turn this feature off by selecting "NO" for the Auto position size setting. If you set it to "NO" you can move your stop loss and the position size will remain the same.

If you leave this setting on then when you adjust the stop-loss you should see that the amount of money you are risking stays the same because the position size is adjusted.

Traders may feel that new positions are opening, but instead, it is the same position being modified with new position size.

FIXED CASH RISK

This allows you to set an amount in monetary terms that you wish to lose for a single trade, as example if you select €5.00 as shown in the image above as your fixed cash risk then the RR tool will automatically calculate your position size so that your risk is around €5.00 no matter where you place the S/L.

% OF YOUR EQUITY & BALANCE

If you select this option the tool will automatically calculate the position size so that you will never risk more than a set % of your account equity or balance.

THE ACCURACY OF THE TOOL

This tool is not perfect, it has an accuracy rate of between 90-100%, the higher the volume of the position size the more accurate it is if you have a low volume of 1K and you have a very wide stop loss then this tool will display a warning to you stating that it can no longer manager the risk.

REMEMBER SL/TP

This option will allow the tool to remember your previous set take profit and stop-loss targets when you open and close the R&R tool, if you set it to zero, it will default to the other values of either last swing or default SL and TP.

Order Type

There are 3 order types used, Market, Limit and Stop, if the pending order option to choose then the take profit target pips is disabled, this is because the target price is placed on the chart in an area where the user can see it and adjust to their preferred price. As the target price line is moved you will see the take profit information updated. Even if you have the auto-position sizing option set to NO, you will still see the pips distance and the position size updated, this is because the distance between the entry price and the stop-loss changes and it automatically calculates the risk that was set.

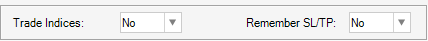

Trading Indices

If you plan to trade indices then you will need to select YES for the Trade Indices option in the settings window.

- The fixed cash or % risk calculation is inaccurate when using an Indice symbol.

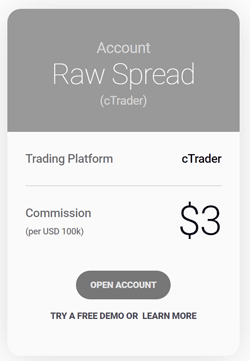

COMMISSION

You can get this value from your broker FxPro clients can expect commission charges only on Forex pairs & Spot Metals on the FxProcTrader platform. FxPro charges $45 per million USD traded. So you would enter 45 in this box.

The picture above shows an IC Markets Raw spread account where it charges $3 for 100K volume trades or 1 lot, cTrader uses the commission per million traded or 1000K, so $3 for 100K is $30 for 1 million volume traded and it is this value you add to the commission settings field.

EXPIRY

When using a Stop or Limit pending order, you can also set the expiry time for the order, so that if it is not filled in a set amount of time it will automatically cancel. The default value is 0-minutes, which means that an order is submitted with no expiry date, if it is set at 60 then the order will expire 60-minutes or 1-hour later and if you want to set it for one day you would use 1440-minutes

CURRENCY

This is the currency that is displayed in the risk/reward tool, we get the correct value from your cTrader account, so you would not normally need to change this value, but you will have the option, just in case your account is set up different.

COMPACT VIEW?

This option is set to No as default and will display the full risk or reward information if you would like to have less information displayed set this value to YES.

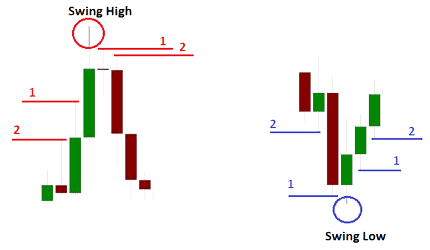

USE THE LAST SWING?

If this option is set to YES, when you open a chart tool it will automatically calculate the last swing high and low prices and for the current timeframe and place the stop loss and take profit accordingly. The classic definition of a swing low is a low on a candle or a bar chart that has a higher low on either side.

- Last swing high – A swing high is formed when the high of a price is greater than a given number of highs positioned around it.

- Last swing low – A swing low is created when a low is lower than any other point over a given time period.

ZONE OPACITY

This allows you to specify how much of the risk & reward zone is shaded, if you select 255 it is completely shaded in with the colour you select, 0 will remove all shading and you will not see any zones, a good value is around 40-80

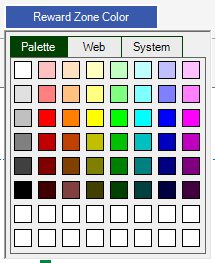

Risk & Reward Zone Colors

You have the option to set your own colours for the zones by clicking on the buttons and picking one.

Stop Loss, Take Profit & Entry Line Colors

You have the option to set your own colours for the zones by clicking on the buttons and picking one.