Every trade starts with planning.

“Plan Buy”, “Plan Sell”

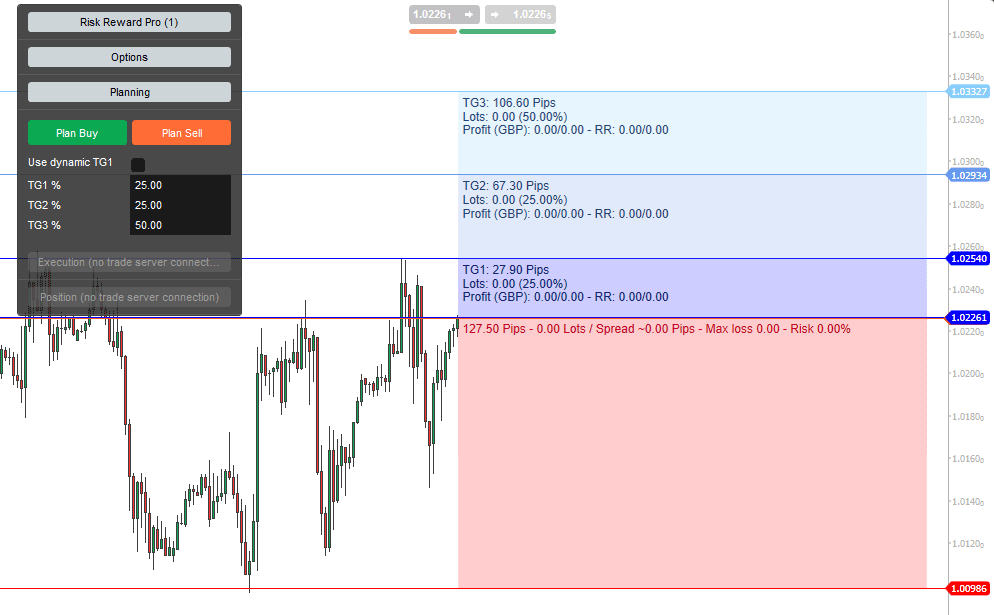

First, you need to decide to plan a long or short trade. Click on the “Plan Buy” to start planning a long, and on “Plan Sell” to start planning a short trade. As soon as you click on the “Plan” buttons, the chart window will show a visual representation of the planned trade:

Here we simply clicked the “Plan Buy” button. Now, the entry, stop and four targets are shown. You can change all price levels by moving the price lines or the coloured box area. We usually move the chart a little to the left and the box area to the right, this gives the best overview.

Whenever you change the distance between the entry and stop price, the volume/lots get re-calculated to match your max risk parameters. The overall volume is then divided by the number of targets and their distribution scheme.

Pro tip: use the shift key on the keyboard while moving the entry or stop price level to keep the distance between entry/stop constant.

Pro tip: use the alt key on the keyboard while moving any price or stop level to keep all distances constant.

Target settings

You can define up to four targets. The volume that gets closed at the target price is given by the percentage you put into the TG1-TG4 boxes. When creating the targets, the tool tries to help you by filling up the missing percentages into the higher targets. Therefore please always start from a lower to higher target so that the tool can support you with the calculation.

Closer Look

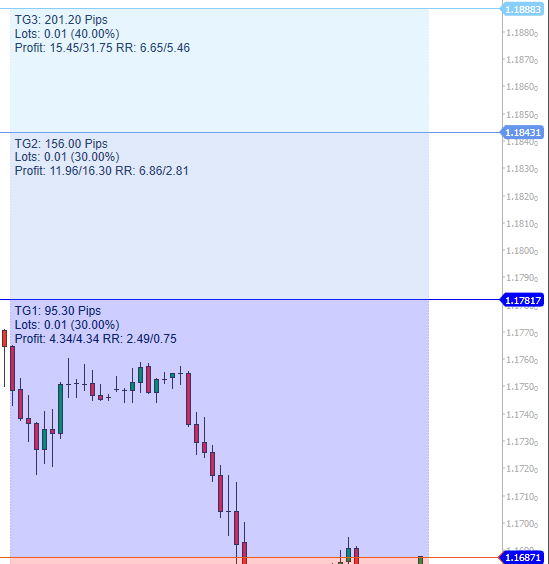

In the example above, the settings are 0.5% risk, 30% at TG1, 30% at TG2 and 40% at TG3. The red area is the stop area with information about the overall trade size and risk. In this case, the stop is set to 12 pips - resulting in 9,46 Lots with a max loss of 961.8 which is 0.5% of the account value.

Pro tip: check the “Spread” value in the red area to see the current “usual” spread of the chosen Symbol. Take this into account while planning the stop distance.

Now check out the target boxes. You see the information on how many pips the target is away from the entry, and how many lots will be closed to meet the percentage for that target.

Example

E.g. for target one, the profit would be 243.67 (-45.54 commissions) = 198.13 and you would achieve a 1:1.2 R for that partial trade. Taking the overall volume into account, the trade would result in a 1:0.29 R at that target. If you check out target two, you see that the partial trade to target 2 will have a 1:2.53 R, while the overall trade gets a 1.05R at that time. Looking at target 3, the last 40% gets closed and this remaining volume will have a 1:3.85R, while the overall trade closes with a 1:2.59R.

Checking out these values will give you a comfortable overview of the overall trade outcome when hitting these targets.

Use Dynamic TG1

Target 1 is a special target which can be used in two modes. If you do not select “Use dynamic TG1”, it is acting the same way as TG2-4. You can put in a percentage of your position that should be closed at TG1.

If you select “Use dynamic TG1”, you can define a risk multiplier that should be taken out of the market at target one. E.g. if you put in a 3 into TG1, the tool will now calculate the volume that is necessary to get a 1:3 Risk/Reward at target one:

As you can see, the tool now calculates the volume that is necessary to get 3R out of the market at TG1. In this case, it needs to close 5.15 lots to reach the 1:3 R/R. The remaining lots are then divided by the given percentage of TG2-4. In this case, 50% at TG2 and TG3. After playing around with the parameters and the price levels, it should be easy for you to plan a trade and get all the necessary information before actually entering the market.

Use limit orders

You can uncheck “Use limit orders”. In that case, the tool will use the current price as the entry price and recalculates all values for each incoming tick. In addition, it will now use market orders instead of limit orders if you decide to execute the trade.

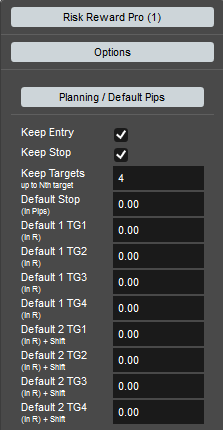

“Plan Buy” and “Plan Sell” Buttons

The “Plan Buy” and “Plan Sell” Buttons will show/hide the trade planning, but the buttons have multiple options that can be used to create a long or short scenario the fast way. To set up the buttons, open the Options / Planning / Default Pips section and put in your default values:

Keep Entry

If you select this, closing and opening the planning does not move the entry price. Without the selection, the current price would be the start price of the calculation.

Keep Stop

If you select this, closing and opening the planning does not move the stop price

Without the selection, the stop price would be calculated by the default stop setting.

Keep Targets (1-4).

Put in the number of targets that should keep the price level while opening/closing.

Default Stop in Pips

Used to calculate the default distance from entry to the stop.

Default 1 TG1-4

Set the Default 1 parameters for the reward you like to archive at Target 1-4. In the example above we have 5R at Target 1 and 10R at Target 2. Target 3-4 will be calculated with default values.

Default 2 TG1-4

Set the Default 2 parameters for the reward you like to archive at Target 1-4. In the example above we have 5R at Target 1 and 10R at Target 2. Target 3-4 will be calculated with default values.

After setting the defaults close the Options section and go back to Planning. Now try the following and check out the different behaviour of the buttons.

- Pressing the “Plan Buy” / “Plan Sell” buttons will show/hide the planning without moving the price levels.

- Pressing the buttons while holding the control key pressed will create a fresh trade with the current price as the start value and use the default 1 parameters from the options. In this example, a trade will be created where TG1 is placed at 5R and TG2 is placed at 10R and the stop is placed 5 pips from the entry.

- Pressing the buttons while holding the control key and shift key pressed will apply the default 2 parameters. In this example, a trade will be created where TG1 is placed at 1R and TG2 is placed at 2R and the stop is placed 5 pips from the entry.

Now it should be very easy for you to keep entries/stop/targets as planned and comfortably reset them and create new default trades at the current price by using the control/shift key.