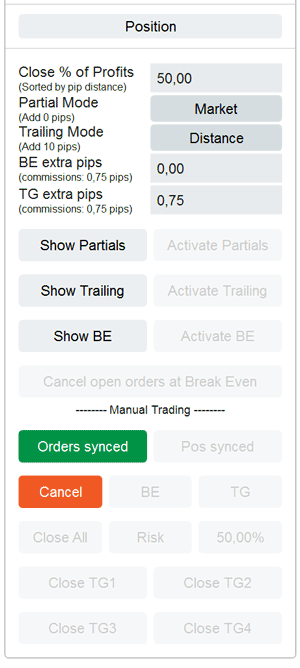

As soon as an order or a position has been created by the “Execution” section, the “Position” section will be opened automatically. It consists of different elements that manage your orders and positions.

Position Section

As soon as you have open orders or positions in the market, these buttons will show up in the Position section:

The upper part contains parameters to be used for the different actions that can be taken:

- Close % of Position: Put in a percentage that you can “spontaneously” close at a given price or click.

- Partial Mode: In the Pro version, only Market can be chosen. The Expert version will allow automated exits. Check out this section of the Expert version.

- Trailing mode: In the Pro version, only Distance can be chosen. Trailing is a standard trailing mechanism that follows the current quote with the max distance that is set in the “Options” section.

- BE extra pips: Put in a number of pips you like to add to the break-even price. If commissions are known, they will pre-fill the field. For a description of how to use it, see below.

- TG extra pips: Put in a number of pips you like to add to the target price. For a description of how to use it, see below.

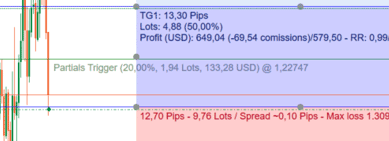

Show Partials

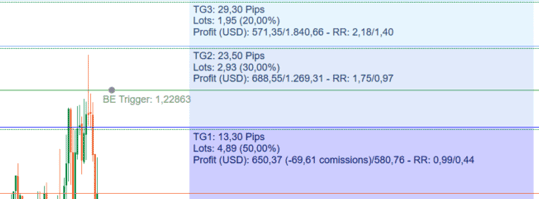

A click on “Show partials” will add a partials trigger line to the chart. The line contains some information about the price, profit loss and lots to be sold. You can change the partials trigger line to a price where you like to take “spontaneous” partials:

When planning is done, you can activate the partials by clicking on the Activate Partials button.

If the price crosses the partials trigger, the position will get reduced by the percentage you put in the parameters above, you can deactivate taking partials by clicking on Deactivate Partials button.

If you like to remove the partials line from the chart, click on the Hide Partials button.

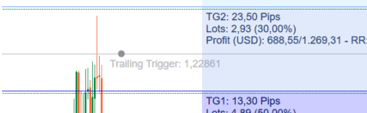

Show Trailing Stop Loss

Similar to the partials, you can add a trailing stop loss. Clicking on “Show Trailing” will add a trailing trigger line to the chart. The line contains the price information when the trailing should be started:

You can move the trigger price level as usual and after that, enable the trailing trigger by clicking the Activate Trailing button.

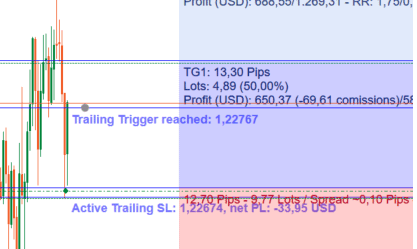

If the price crosses the trailing trigger line, the stop loss price will follow the price with a min distance of the “Trailing distance” put in the parameters above:

After the trailing stop loss is activated the stop loss is moved and an information line is shown with the current price and profit loss at stop loss level.

You can deactivate the trailing by clicking on Deactivate Trailing button.

You can remove the trailing stop loss by clicking on the Hide Trailing button.

Show Break Even

Similar to the trailing and partials, you can add a break-even trigger. If you click on “Show BE” a BE Trigger line will appear in the chart:

Change the price of the BE trigger to your selection. To enable the break-even trigger, click on the Activate BE button.

If the price crosses the break-even trigger line, the stop-loss price is moved to the break-even point. The extra pips given in the parameters above are applied in addition, you can deactivate the break-even trigger by clicking the deactivate BE button.

You can also remove the break-even by clicking on the Hide BE button.

You can also click on the Cancel orders at Break-even button to cancel all unfilled pending orders whenever a Break-Even event is triggered. This can be done by the market or by using the “Move to BE” button.

Manual Trading Section

The above operations of partials, trailing and break even are semi-automated. You plan the levels and activate the function.

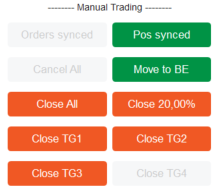

Sometimes it is necessary to manually interact with the existing positions. You can find the following buttons in “--Manual Trading--” section:

Orders synced

If you select this option, you can move the entry, stop and take profit prices of any existing order in the chart - and all other orders are modified as well.

- If you change or drag the entry price of a single order, all orders for the planned trade are moved to the same entry price.

- If you change or drag the stop value for a single order, all orders for the planned trade are moved to the same stop price.

- If you change or drag the take profit price of a single target order, all orders for that target group are moved to the same take profit price.

This means you can manipulate the split orders from the execution section easily altogether. Changing one price will apply to all others of that group.

Keep in mind that after you created the orders, the calculation of order size is done and all placed orders will NOT be modified in size anymore!

Orders unsynced

If you disable syncing of orders, you can modify/drag every single order on its own without affecting the others.

Cancel All (orders): This allows you to cancel all open orders for the currently planned trade

Positions

As soon as you have a position in the market, new buttons will show up in the Positions section:

Positions are synced when moving

If you select this option, you can move the stop and target prices of any existing position in the chart - and all other positions are modified as well.

- If you change or drag the stop value for a single position, all positions for the planned trade are moved to the same stop price.

- If you change or drag the take profit price of a single position, all positions for that target group are moved to the same take profit price.

This means you can manipulate the split positions from the execution section easily altogether. Changing one price will apply to all others in that group. Keep in mind that after you created the positions, the calculation of order size is done and all placed positions will NOT be modified in size anymore!

- Positions are not synced, If you disable syncing of positions, you can modify/drag every single position on its own without affecting the others.

- Move to BE - Let's manually move the stop price to Break Even (+ extra pips) by just clicking on the “Move to BE” button. The button is enabled with the first established position.

- Close All - If you click on this button, all positions will be closed immediately with a market order.

- Close XX% - the shown percentage is configured by the parameters above. A click on the button will immediately close XX% of the overall position by market. See the parameter section above for more information.

- Close TG1 -TG4 - If you have positions for a target group, the buttons get enabled. If you click on one of these buttons, all positions of that target group will be closed immediately with a market order. This allows you to close parts of the trade before reaching the take-profit price.

If you have positions for a target group, the buttons get enabled. If you click on one of these buttons, all positions of that target group will be closed immediately with a market order. This allows you to close parts of the trade before reaching the take-profit price.

Cancel open orders at Break Even

You can enable “Cancel open orders at Break Even” to cancel all unfilled pending orders whenever a Break-Even event is triggered. This can be done by the market or by using the “Move to BE” button.

Manuel Trading Section

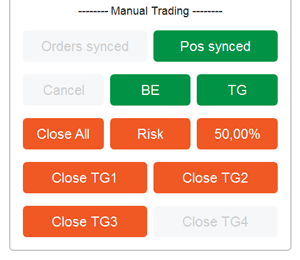

The above operations of partials, trailing and break even are semi-automated. You plan the levels and activate the function. Sometimes it is necessary to manually interact with the existing positions. You can find the following buttons in the “--Manual Trading--” sub-section:

- Orders synced

If you select this option, you can move the entry, stop and take profit prices of any existing order in the chart - and all other orders are modified as well.

Examples:

If you change or drag the entry price of a single order, all orders for the planned trade are moved to the same entry price.

If you change or drag the stop value for a single order, all orders for the planned trade are moved to the same stop price.

If you change or drag the take profit price of a single target order, all orders for that target group are moved to the same take profit price.

This means you can manipulate the split orders from the execution section easily altogether. Changing one price will apply to all others in that group.

Keep in mind that after you create the orders, the calculation of order size is done and all placed orders will NOT be modified in size anymore!

- Orders unsynced

If you disable syncing of orders, you can modify/drag every single order on its own without affecting the others. - Cancel All (orders)

Allows you to cancel all open orders for the currently planned trade.

Positions

As soon as you have a position in the market, new buttons will show up in the manual trading section:

Positions synced

If you select this option, you can move the stop and target prices of any existing position in the chart - and all other positions are modified as well. This works the same way as “Orders synced”

- Examples:

If you change or drag the stop value for a single position, all positions for the planned trade are moved to the same stop price.

If you change or drag the take profit price of a single position, all positions for that target group are moved to the same take profit price.

This means you can manipulate the split positions from the execution section easily altogether. Changing one price will apply to all others in that group.

Keep in mind that after you created the positions, the calculation of order size is done and all placed positions will NOT be modified in size anymore!

- Positions unsynced

If you disable syncing of positions, you can modify/drag every single position on its own without affecting the others. - BE (Break Even)

Let you manually move the stop price to Break Even (+ extra pips) by just clicking on the “BE” button. The button is enabled with the first established position. - TG (Target)

With this button, you can modify all targets to the entry price plus/minus the value of the TG extra pips entry. This is especially useful if you like to close the position at the entry price +X. If you decide that the position does not react correctly as you expect, you can close all of it at a given target price (entry + extra pips). - Close All

If you click on this button, all positions will be closed immediately with a market order.

- Risk (close Risk)

If your position is already in some profit and you like to remove any risk with the position, you can- move the stop to break even OR

- close as many positions as necessary to get zero risk at the stop-out level.

Clicking on the Risk button will do exactly this. It sells the necessary amount from your position to make a risk-free trade. After pressing the “Risk”-Button you can leave the stop at the current position and have a risk-free trade in your portfolio.

- Close XX% - the shown percentage is configured by the parameters above. A click on the button will immediately close XX% of the overall position by a market order.

- Close TG1 -TG4

If you have positions for a target group, the buttons get enabled.

If you click on one of these buttons, all positions of that target group will be closed immediately with a market order. This allows you to close parts of the trade before reaching the take-profit price.

Cancel open orders at Break Even

You can enable “Cancel open orders at Break Even” to cancel any unfilled pending order whenever a Break Even event is triggered. This can be done by the market or by using the “BE” button.