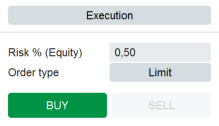

The execution section consists of parameters that decide about your risk and used order type. The Buy/Sell button will place a pending order or execute your trade.

If you decide to have only a single order/position per target, set the min lots to 0.01 and the max lots to the max lots available for that symbol, but the parameters above let you create much better trade setups.

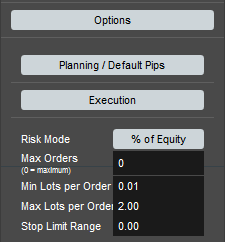

The execution section seems to be very minimalistic, but under the hood, a lot of things are happening. To give you the details, let’s take a look at the options for the execution section:

Before placing any order you should be familiar with the shown options:

- Risk Mode

- % of Equity: the risk calculation takes the equity value of your account (balance incl. profit/loss of existing positions)

- % of Balance: the risk calculation takes the shown account balance

- Fixed amount: risk only the amount given in the Risk field in the Execution part.

- Stop Limit Range

In case you use the Stop Limit order type, you can set the stop limit range that will be used for these kinds of orders. Be careful using the Stop Limit order type - your order may not be executed but cancelled if it jumps over the allowed Stop Limit Range. Execution of these orders is usually not guaranteed.

Max Orders / Min Lots per Order / Max Lots per Order

These options are essential and you need to understand how to set them correctly. With the help of these options, the tool splits down the overall trade size into multiple orders and/or positions.

Background

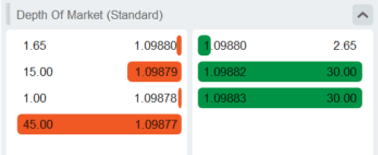

When you look at the best bid/ask prices in the market depth box, you can see that the best price is only available for a small lot size.

This means: that if your resulting order size is larger than the shown lot size at the best price, it will not fill even if the price gets hit. It will only fill if the complete size of the order can be filled at once. There is just no partial filling of orders while creating a position. It is a kind of All-Or-None filling.

Pro Tip: splitting down an order into smaller pieces/lots will allow you to fill these orders at the best possible price.

The execution parameters allow you to do exactly that. It splits down the overall volume per target into groups of orders. To not get overwhelmed with orders and positions, you can set “Max Orders” to a meaningful value. Practically, the number of orders is just limited by your broker, but it makes sense to not have hundreds of orders/positions open.

After you decide on the maximum number of orders/positions, you can now set a range you like to use for the resulting orders. Set the “Min Lots per Order” to ignore very small orders and set “Max Lots per Order” to your favourite lot size.

Pro Tip: take the “Max Lots per Order” size from the market depth window!

In this example, you could get the best execution with a 1.65 as “Max Lots per Order”.

Because the overall volume per target gets divided into the best fitting size, you may get a set of orders for each target. This is essential to understand. Managing these groups of orders and positions will be part of the Position section.

Pro Tip: you can fixate the size of all orders to a given value if you put the same size into “Max Lots per Order” and “Min Lots per Order”.

Execution

After all, parameters are set, you can create orders or positions when hitting the “BUY” or “SELL” button. Limit orders are generated if you select “Use limit orders” in the planning section. If not, market orders are generated and will result in positions instantly. So be carefully pressing the BUY / SELL button.

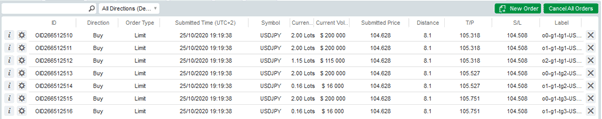

Hitting the button with the example shown above will create this set of orders:

As you can see, the tool generated 7 orders. Each one of the orders has a unique label that allows the tool to manage the order/positions and target groups.

From the planning example before, the tool showed the following:

TG1: 5.15 lots

TG2: 2.16 lots

TG3: 2.16 lots

The created orders are:

TG1: 3 orders with 2x2 lots + 1x1.15 lots = 5.15 lots

TG2: 2 orders with 2 lots + 0.16 lots = 2.16 lots

TG3: 2 orders with 2 lots + 0.16 lots = 2.16 lots

The entry, stop and take profit prices are taken from the planning.

Pro Tip: use a demo account to test the behaviour/splitting of orders before applying to your real-world account.

Limitation: “Max Orders” is a hard limit

The tool will never create more than the given number of “max orders”. If the splitting of orders for a target cannot be fulfilled by the “Max Lots per Order”, the tool will automatically increase the “Max lots per order” to fulfil the overall volume for that target.

Therefore the “Max lots per order” is a “nice to have” parameter which may be overridden to get the overall volume placed for a target.

So don’t be concerned if you see orders with more lots than you put into the “Max lots per order” parameter.