Open a cTrader Demo Account

Finding the right broker to start your trading can be daunting, we recommend that you take a look at IC Markets who are not only highly regulated but also have accumulated thousands of real-online positive reviews on Trustpilot, this is an Australian-based broker, but anybody can sign-up with them.

Why Do you Need a Broker?

You may ask, why do I need a broker to use the cTrader platform, this is because it is the broker who provides the data and processes your orders through the cTrader trading platform and because of this each broker offers an exact copy of the platform, but each one has the brokers logos and name shown on the screens.

Who is IC Markets?

IC Markets is regulated by the top-tier Australian regulator, the Australian Securities and Investments Commission (ASIC) and is perfect for forex traders preferring easy account opening and free deposit and withdrawals. This broker has one of the highest levels of positive customer feedback on Trustpilot and the last time we looked they had over 9000 reviews with an average rating of 4.8 out of 5, which is an excellent achievement which means the customers are happy and if the customers are happy then their support, services and fees are also good.

IC Markets cTrader Platform

The IC Markets cTrader platform is a market-leading trading platform designed from the ground up with Forex CFD trading in mind, they offer very low spreads, raw pricing, and ultra-fast execution with deep liquidity. their pricing aggregates a mix from up to 25 different price providers which means that they are always able to source the best price and keep the spreads tight, especially during high volatility times such as news announcements.

Free, no-obligation demo for as long as you want.

Scalping Friendly Broker

This broker allows the cTrader platform to have no restrictions on trading, they have some of the best trading conditions for scalping and high-frequency trading globally that allows traders to place orders between the spread as there is no minimum order distance and a freeze level of 0. This allows orders including stop-loss orders to be placed as close to the market price as possible.

64 Currencies & Metals + 15 CFDs

IC Markets Trade 64 currency pairs plus 15 major equity indices including the FTSE 100, S&P/ASX 200 and Dow Jones Index 24 hours a day with a spread of 1 point.

Leveraging Allowed up to 1:500

Open an account and you can leverage up to 1:500 on the IC Markets cTrader platform, this allows traders to use a use high-level of leverage to suit their trading style and get the best out of their manual and automated trading strategies.

Smart Stop Out

The trader's account is protected by the Smart-Stop-Out logic in cTrader which has been designed to provide maximum protection to the trader's account. It works by checking if the Margin Level falls below the Smart Stop Out Level and if this happens then positions will start being closed partially until Margin Level reaches above Smart Stop Out.

Funding & Withdrawal Options

You have various methods of funding your account, you can fund using one of 10 funding options which include:

- Credit/Debit card

- Moneybookers

- wire transfer

- broker to broker transfer

- branch deposits China Union Pay, Neteller.

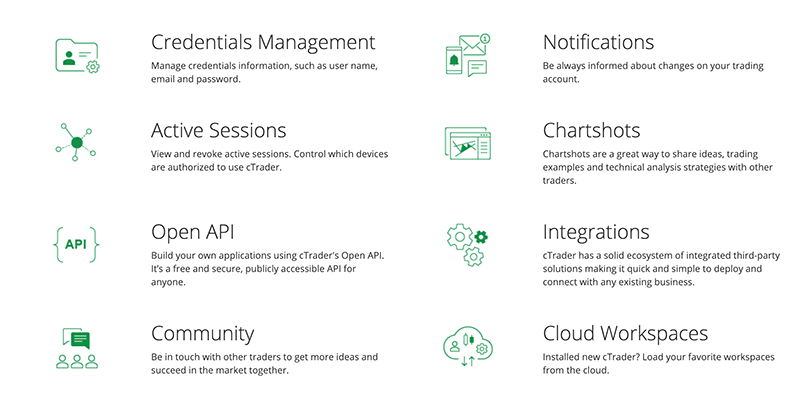

cTrader Features

CTrader at IC Markets offers deep liquidity in 64 currency pairs and 16 major equity indices with exceptional execution speeds and no trading restrictions. We found that IC Markets is one of the premier True ECN forex brokers across the globe.

Customer Service

IC Markets offers excellent customer service with support staff available by phone, e-mail, and live chat 24/7 with toll-free numbers for customers in Australia, Thailand, and the United Kingdom. Moreover, also clients have access to a dedicated Chinese support centre. All traders need a broker they can contact at any time and get a friendly response and as a result, customers should have no issues contacting support staff and receiving help in a timely manner.

Islamic Account Option

The cTrader IC Markets plan also offers Islamic accounts which are also known as a swap-free accounts, this was designed for clients who cannot earn or pay the interest due to religious beliefs.

Trustpilot Customer Reviews

This broker has some of the best real-online customer reviews for a retail broker, as with all brokers there will be some unhappy customers, but to achieve an excellent rating with over 1.2K reviews is pretty impressive in this industry where many traders fail and blame the broker.