cTrader Harmonic Cypher Pattern

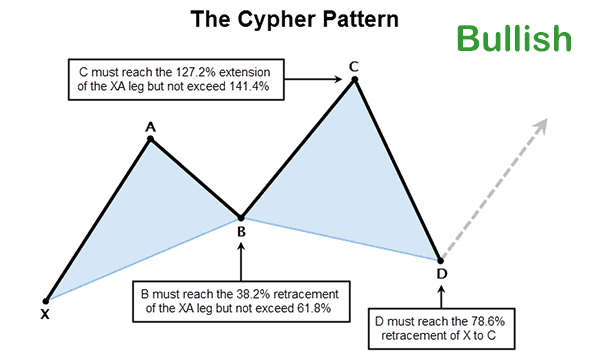

The cTrader Cypher pattern is a four-leg reversal pattern which follows specific Fibonacci ratios to identify changes in the trend, this pattern forex appears less frequent than other harmonic patterns because the market price has to satisfy such rigid Fibonacci ratios. The Cypher pattern is a member of the Harmonic trading patterns and is one of the most exciting patterns to form as it has the highest winning rate.

The Harmonic Cypher Pattern is made up of 5 swing points, X, A, B, C and D.

Pattern Conditions

- AB= 0.382 to 0.618 retracement of the XA swing leg.

- BC= extend to minimum 1.272 and maximum 1.414 of the XA swing leg.

- CD= retrace to 0.786 of the XC swing leg.

Hot Tips

- In our experience, this pattern will work the best when the market is calm and in a strong trending market, when there is a major news event, the Cypher pattern becomes less reliable.

- The bigger the pattern as in the longer it will take to form the pattern shows stronger support & resistance.

How to Trade The Cypher Pattern

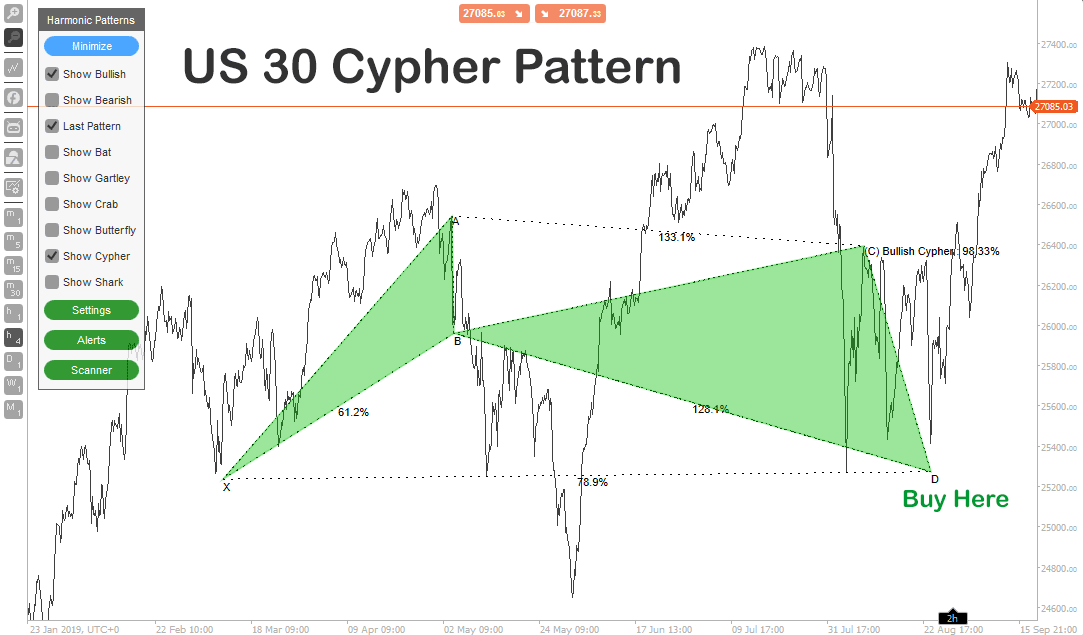

The Cypher pattern is one of the most exciting harmonic patterns to trade and this is because it has a high winning rate. You do not need to draw the Cypher pattern if you use the cTrader Harmonic Pattern Scanning tool that will automatically draw the pattern onto the chart when it forms.

Buy Entry

You would normally submit a buy order when the pattern forms at the point D once the CD-Swing leg has reached the Fibonacci retracement of 78.6%, the pattern below shows 78.9% due to the fact that the cTrader Harmonic Scanning Software allows tolerance to be set for custom patterns, more information on the settings can be found here.

Stop Loss

You would normally place your stop loss below the point X which is the best place to place it, this is because any break below will automatically invalidate the trade.

Take Profit

This type of strategy is a reversal strategy where we want to make sure we capture as much as possible from the new trend and the Cypher pattern has a conservative take profit target, so we take profits once we reach point A of the pattern.

Conclusion

We find that the rules of the Cypher pattern trading strategy is pretty much straightforward and even though it has a bigger winning ratio than the other patterns, the Cypher pattern will be detected very rarely on the chart, so we will need to take full advantage when they do show up.

Harmonic Pattern Trading

An advanced trading method like harmonic trading uses pure price action which has a determined system for price pattern recognition and Fibonacci techniques which cover the Harmonic Trading approach.