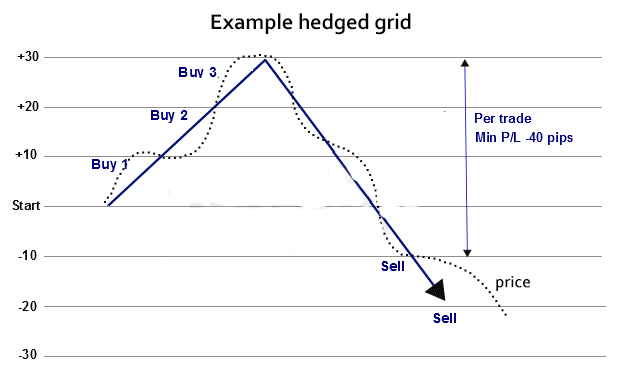

A classic “hedged grid” is made up of both long and short positions. As the name suggests, there’s a measure of inbuilt hedging – or loss protection with this approach. The basic idea is that any losing trades can be offset by the profitable ones.

Ideally, at some point the entire system of trades becomes positive. We would then close out any remaining positions and the profit is realized.

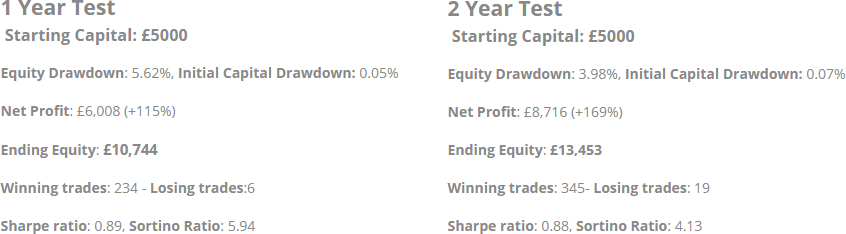

cTrader Grid-Hedge Automated Trading System

This is a great introduction to automated trading with this fully automated trading strategy which opens positions based on a grid system. Grid trading is a highly profitable and mechanical trading strategy that has no reliance on direction, profits from volatility and uses the intrinsic wavy nature of the market. It requires no market timing or complicated analysis, but rather, the ability to forecast where the market won't go in the long term and a good understanding of "equity, exposure and leverage".