Neural Network Libraries for your Trading Platform

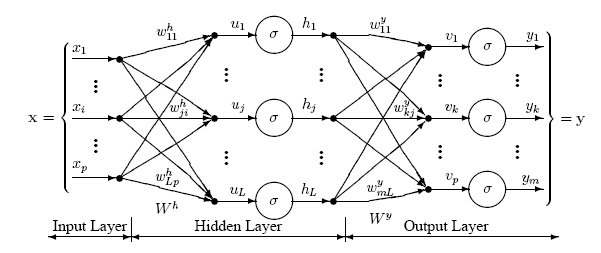

Neural networks are state-of-the-art, trainable algorithms that simulate certain aspects in the functioning of the human brain. This gives them a unique, self-training ability, the ability to formalize unclassified information and, most importantly, the ability to make forecasts based on the historical information they have at their disposal.

Using program code, you can train a neural network with information about how to trade, and the network will attempt to forecast the market based on what it learned from the training data it was supplied.

To train a neural network, you must have a data set containing sample data (inputs), which correspond to the results (targets).

For example, you may either use technical indicators, or you may use the price of various stocks, gold, oil, or currencies, or even fundamental data as inputs into a neural network.

The target value may be future price, market direction, or volatility, for example.

The data used for training is usually obtained using historical data in which the outcomes are known. This is called the in-sample training set.

Once the training and machine learning process is complete, the neural network will be able to predict answers when new inputs are processed.

This book shows how neural networks may be put to work for more accurate forecasting, classification, and dimensionality reduction for better decision making in financial markets — particularly in the volatile emerging markets of Asia and Latin America, but also in domestic industrialized-country asset markets and business environments.

https://www.amazon.com/Neural-Networks-Finance-Predictive-Academic/dp/0124859674

Interested in us developing a Neural Network Library for cTrader? Please contact us