Many traders get caught out when they have tight stop losses with their cTrader positions during times of low volatility or low volume of trading. The spread is the difference between the bid/ask price can widen and take out the stop losses of your positions.

What is Bid/Ask Spread?

The Bid/Ask spread refers to the distance between the ask and bid prices of a symbol, so a spread of 0.5 pips means that the difference between the bid price and the asking price is 0.5 pips, this is where brokers make their markup & fees to place your trades with the banks.

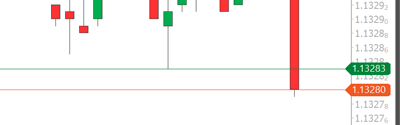

The above picture shows a green line (bid price) and an orange line (ask) price, the difference between these values is the spread, if a buy trade was open it would close in profit when the orange line hits the take profit line and close at a loss when the green line hits the stop loss.

As you may have worked out when the trade opens if the spread is 1 pip then your position will be losing 1-pip from the start and will need to gain 1 pip plus any commission just to break even.

Unexpected Stop Loss Hit

Have you ever noticed that your position has been stopped-out and you thought the broker did this?

Stop losses can be hit and positions closed at a loss when the spread widens due to low trading volume, so not many traders in the market submitting orders, this is caused by the bid/ask spread explained above widening to enough pips to reach your stop-loss price. So it is not the broker working against you, but instead a common feature of how the financial markets work.

How to Prevent Losses?

The only way to stop your trades from closing at a loss is to use a spread alert indicator that will send you a message via the Telegram messaging service directly to your mobile phone or an on-screen warning.