A drawdown is the reduction of one’s capital after a series of losing trades, So we know that risk management will make us money in the long run, but now we’d like to show you the other side of things.

Consider this example with a 50% max equity drawdown

Let’s say you have a £1,000 and you have open positions that are £500.00 in the red, you if you closed them now you would lose £500.00.

Even If You Leave The Positions Open And They Close With A Profit, Your DrawDown Will Be 50%

Consider this example with a max equity 5% drawdown

Let’s say you have a £1,000 and you have open positions that are £50.00 in the red, you if you closed them now you would lose £50.00.

Even If You Leave The Positions Open And They Close With A Profit, Your DrawDown Will Be 5%

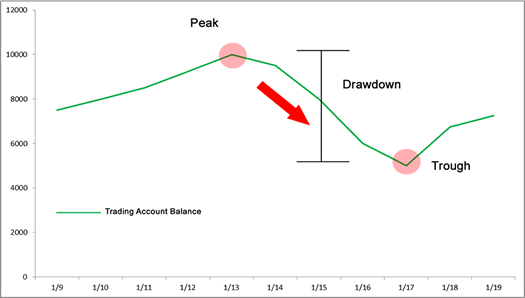

Drawdown is normally calculated by getting the difference between a relative peak in capital minus a relative trough.

Our View on DrawDown %

The amount of equity of capital you want to risk depends on you! if you want to be a low-risk trader and you are not a gambler you may want to look at 5% or less drawdown, if you are a gambler then a 50% drawdown is pretty much a flick of the coin to lose 1/2 of your money.

Why Does Drawdown Matter?

You will see many automated trading robots where the Drawdown is around 50%, these are high-risk systems and although they may show very high returns, you are effectively gambling, if you are looking at your trading as a long-term business and not to make a quick buck and get out then you should be focusing on your risk-management with a lower risk. If you can get an annual return of more then 10% with a drawdown of less then 5% then this would not make you rich but would give you a better chance of succeeding then the high-risk traders.

"Why Do You Think The Retail Trading Industry has Such a High Failure-Rate"

Get Used To Drawdown - It is Part of Trading

The key to being a successful forex trader is coming up with a trading plan that enables you to withstand these periods of large losses. And part of your trading plan is having risk management rules in place.

Only risk a small percentage of your “trading capital” so that you can survive your losing streaks.

Remember that if you practice strict money management rules, you will become the casino and in the long run, “you will always win.”

Our Algorithmic Trading School

Everybody starts as a beginner, you need to understand the basics before you can move forward, time and effort will reward you with the skills you require. Do you have many ideas that you want to automate with an Algorithmic Strategy or pull data from the internet, but you do not have the funds to pay developers? We plan to offer Free training videos to help you learn Microsoft C# using Visual Studio for the cTrader & cAlgo trading platform.