Our version of the Advanced cTrader Forex protection tool will protect all your positions created manually, by automated trading systems or when a pending order becomes a position. This tool's protection is listed below and can be applied to a single symbol or all symbols.

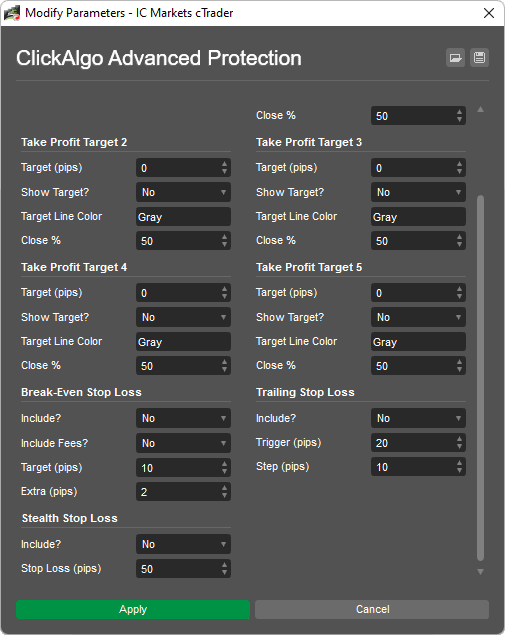

- 5 Take Profit targets with % volume close.

- Set your targets in pips or price.

- A break-even stop-loss.

- A trailing stop-loss.

- A stealth stop-loss to hide from the broker.

- Show or hide take-profit target lines.

- Works with Market, Pending and orders opened by automated trading systems.

Logging: If this is set to YES, then the cBot log will log all events using this tool to manage your positions.

How does it work?

This tool could not be simpler; you attach it to a chart in the cTrader Trade window or add a new instance in cTrader Automate, configure your settings and start the cBot. If you needed to manage your orders for EURUSD, you would do the following.

- Open a EURUSD chart in cTrader.

- Attach the cBot to the chart.

- Configure the settings.

- Start the cBot.

Target Type

You can set your take profit targets in pips or the target price of the instrument.

Important

The chart you attach the cBot to will manage any trade that opens for that symbol. For example, for EURUSD, it will execute all EURUSD orders.

How do you manage multiple symbols?

If you need to manage other symbols, open a new chart and follow the above steps. You must add the cBot to all symbol charts you wish to manage.

How do the take-profit targets work?

There are five take-profit targets, which allow a position to close a percentage of its volume when pre-set pip targets are reached. You can use just a single target or up to a maximum of five. To turn a target off, you just set the Target (pips or price) to zero, and to completely close a position, you just set the Close % to 100.

Example Setup

An example setup would be where a position closes 50% of its volume when a position reaches 10 pips in profit and then closes 100% of the volume when it reaches 20 pips in profit. As all the volume is closed, the position will close.

Take Profit Target #1

- Target type: Pips

- Target 10 pips

- Close 50%

Take Profit Target #2

- Target type: Price

- Target 1.0420

- Close 100%

Take Profit Targets #3-5

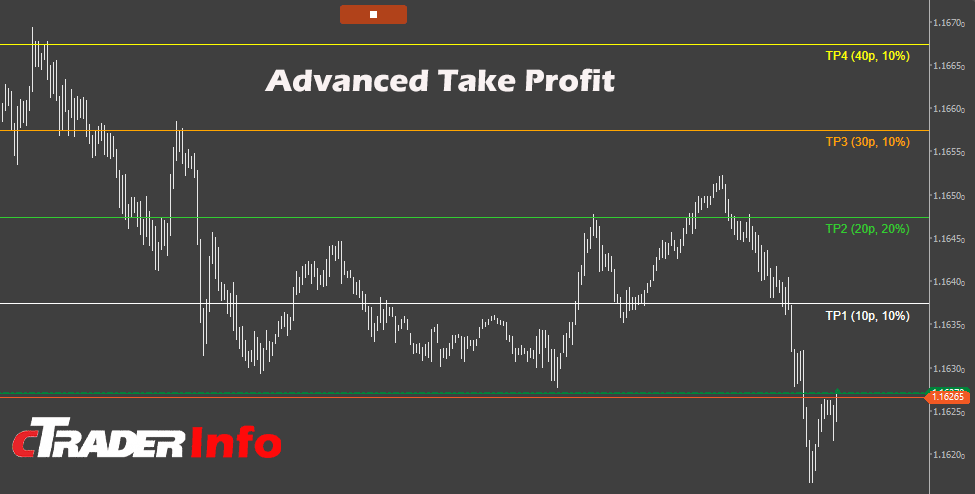

Visible Take Profit Target Lines

It is also possible to hide or show the take profit target lines and change the colour of the line, this works better with a single trade, if you had 10 trades with 10 take profit lines, you would have 100 lines on the chart, so use this feature only for a few trades at a time.

What do the labels mean?

You have the ability to show or hide the take profit line labels, the chart below shows targets for a buy position, if you submit a sell order you will also see target lines below the price, so you will end up with 10 take profit lines on the chart, 5 for the buy and 5 for the sell.

TP4 (40p, 10%) = Take profit target 4 which has been set at 40 pips above the entry price, and once the target is hit, it will close 10% of the position size.

How does the break-even stop-loss work?

The break-even stop loss is a standard feature with all our trading systems. It will be activated when any position is x pips in profit, and the stop loss will be moved to a financial break-even if the extra pips are left at the default value of zero.

A financial break-even covers all the fees involved from the broker when an order is filled.

- Extra pips: These are additional pips. The stop loss will be moved in profit past the entry price to lock in extra profit.

No Financial Break Even?

If you do not want the broker transaction fees included,, which will place your stop loss in profit rather than exactly at the entry price,, you can turn this off by setting the "Include Fees" parameter to No. This will place your stop loss exactly at the entry price.

Slippage

When you live trade on volatile markets, you may not see the stop loss set at the exact entry price due to slippage.

How does the trailing stop loss work?

The trailing stop-loss feature is activated when the gaining pips reach the trigger value, the stop-loss will be moved x pips behind the price as defined in the Steps (pips) setting and as the price moves in profit the stop loss trails behind this price and locks in the extra profit, once the price retraces the step pips and hits the stop loss the position is closed in profit.

How does the stealth stop-loss work?

The stealth stop loss feature is very simple, it just closes any position when it is losing x pips as defined in the stop loss setting. The stop loss is not sent to the broker but instead stored in memory in the cBot, and a request is sent to the broker to close the position instead. This feature will only work if your position has no stop loss.

Watch a Demo Video

We have recorded a hands-on tutorial on how to use risk management tools correctly.

Duration: 10 minutes - Watch full screen on YouTube

How To Install & Remove

First, make sure you have the cTrader trading platform installed and then simply unzip the file and double-click on it to automatically install it onto the platform.

Any Questions?

If you have any questions, please first search our product help forum for the answer. If you cannot find it, post a new question.

Need a Broker

If you are still looking for a broker you can trust, take a look at our best cTrader broker site.