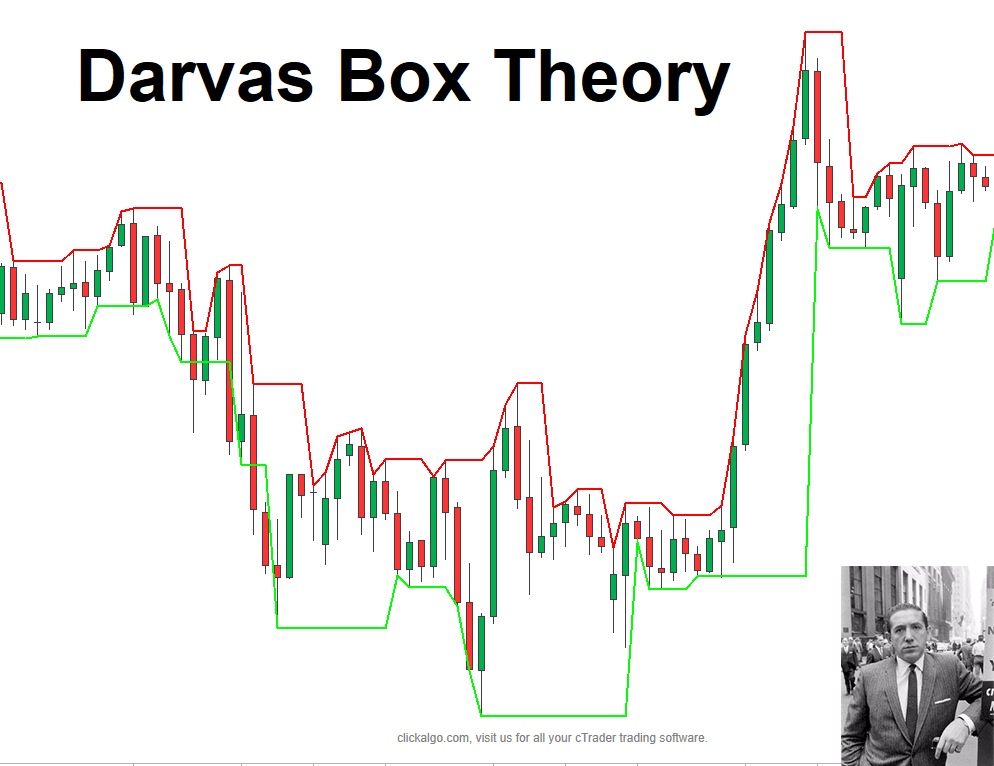

This is a timeless classic trading strategy that was first used in the 1950s created by a stock trader called Nicolas Darvas who turned $25,000 into $2,000,000. The core of his strategy uses an indicator called the Davros Box Theory which draws boxes around the most recent highs and lows of an instrument.

Nicholas Darvas became famous after he wrote his book, “How I made $2,000,000 in the stock market.”

The strategy and indicator is very simple to use and appeals to both a novice and experienced trader and works by taking advantage of a momentum trend by drawing a box around the latest highs and lows.

Darvas Box Rules

The following rules will help you trade using the Darvas box theory and cTrader indicator.

- Scan the markets for Forex or any other symbol that is making new 52-week highs.

- Do not take into consideration any symbols that have retreated from the 52-week high for 3 or more days.

- If any low price is formed then the symbol price should not drop below for 3-days in a row.

- Place buy trades when the symbol price has a breakout on the upper Darvas box.

- Place sell trades when the symbol price has a breakout on the lower Darvas box.

Using Volume for Strategy

One of the main parts of the Darvas strategy is the volume which is used to get an idea of the symbol price momentum and therefore able to get higher returns on trades over a shorter time rather than small returns over a longer timeframe. Darvas also used technical indicators to manage the risk so that any sign of a price reversal then closed his trades quickly.

Volume Indicators

The trading platform you will use should have a volume indicator you can use, the cTrader trading platform also has a few 3rd party volume indicators, one that we offer a few free and paid volume indicators.

Technical & Fundamental Trading

Many traders today still use a combination of analysing news events and technical analysis to help determine trade opportunities, you cannot trade using technical analysis alone due to the fact the markets are unpredictable when an unforeseen news event happens and the price of a stick can crash or rise very quickly.

Download the Darvas Box Indicator

If you would like to try the Darvas Theory strategy with your trading then you should be able to get hold of the indicator with a simple web search, alternatively, you can download our version for the cTrader trading platform.