The cTrader trading platform is a true ECN (Electronic Communication Network) trading platform, designed specifically with forex and metals trading in mind which has no dealing desk. A No-Dealing-Desk or NDD is offered by a Forex broker that provides unfiltered access to the interbank market rates of exchange.

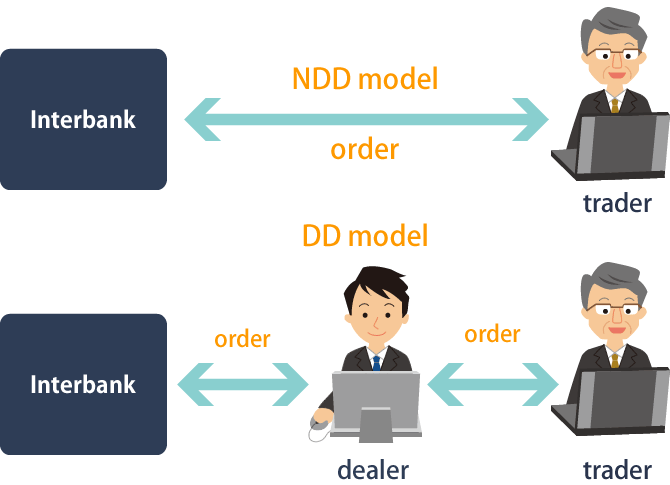

Non-Dealing-Desk (NDD) is a term used by Forex brokers to identify themselves as a broker who does not operate a dealing desk (DD), it is true that the financial markets can not exist without dealing desks somewhere, but an NDD broker is usually considered a good thing by retail traders due to the reduced conflict of interest.

Below shows how the dealer is removed with a Non-Dealing-Desk (NDD) broker

- No-Dealing-Desk brokers allow customers to trade directly with the interbank rates.

- Direct access to the rates help the traders in some cases but hurt them in others.

- Trading with an NDD broker guarantees the trader that their broker will have no conflict-of-interest with their trades.

No Dealing Desk Brokers

cTrader has a few brokers who use the NDD model, we have selected the best-of-the-best.