The Parabolic SAR (Stop and Reverse) is a technical analysis indicator developed by J. Welles Wilder Jr., an American mechanical engineer and technical analyst. Welles Wilder is well-known for his contributions to technical analysis indicators, including the Average True Range (ATR), Relative Strength Index (RSI), and Parabolic SAR. He introduced the Parabolic SAR in his book "New Concepts in Technical Trading Systems" published in 1978.

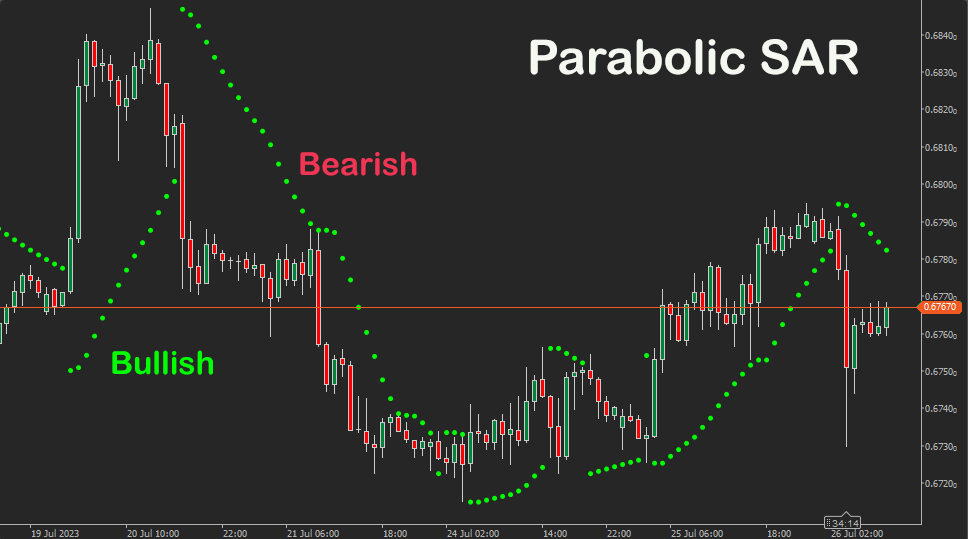

The Parabolic SAR indicator is shown on the chart by a series of dots that appear either above or below the price chart. When the dots are below the price, it suggests an uptrend, and when the dots are above the price, it indicates a downtrend. The dots are placed based on calculations that take into account the price movement and the acceleration factor.

The Parabolic SAR indicator also provides potential entry and exit signals that are used in this cTrader cBot to enter both buy and sell trades. When the price crosses above the Parabolic SAR dots, it opens a long (buy) position, and when the price crosses below the dots, it opens a short (sell) position.

When to Use a Parabolic SAR Strategy?

It's worth noting that the Parabolic SAR is most effective in trending markets but may produce false signals in sideways or choppy market conditions. Therefore, it is best to add to this automated system additional indicators and analysis techniques to improve the accuracy of trading decisions.

How Does the cBot Open & Close Trades?

This strategy will open a buy trade when the Parabolic SAR value is greater than the last candle's lowest price and the Parabolic SAR's last 2 values are greater than the previous 2 candle's high price. The opposite is true for a sell trade.

parabolicSAR.Result.Last(1) > Bars.HighPrices.Last(1) && _parabolicSAR.Result.Last(2) < Bars.LowPrices.Last(2)

- Only 1 trade will be open at any time.

- A Buy signal will close a Sell trade

- A Sell signal will close a Buy trade.

Stop Loss & Take Profit Calculation

The strategy uses a standard fixed stop loss and takes profit for existing trades.

You can add additional risk management and other trade rules yourself or by contacting our development team.

Parabolic SAR cBot is provided with full source code by Spotware.com

How to Optimise the Settings

We have also created a simple video showing how you can run cTrader Automate Optimisation for this cBot to find the optimal parameter values.

How to Attach Indicator to Chart

You do not need to attach the Parabolic SAR indicator to your chart when you run the cBot, but it is a good idea to visually see the indicator to check your trade rules for opening and closing trades and any risk management.

How To View The Source Code

To view the source code for this cBot, you will first need to make sure you have downloaded and installed cTrader Desktop, you can also scroll to the bottom of this page for instructions on how to install the cBot. Once installed you will have the cTrader application open, next you need to navigate to the Automate application and click on the name of the cBot, the source should show in the right-hand window.

If you need more help watch a video tutorial on how to use cTrader Automate.

Learn Algorithmic Trading

In this instructional guide, we aim to assist you in acquiring the necessary skills to engage in market trading through automated trading strategies (cBots) using the cTrader Desktop trading platform. By the conclusion of this tutorial, you will gain the confidence to employ a cTrader cBot alongside the Algo application of cTrader, enabling you to automatically execute and handle your market orders. This course is designed to familiarize novice traders with the fundamental principles of algorithmic trading utilizing the cTrader platform.

Learn Microsoft C# for Algo Trading

If you are new to coding your cTrader cBot for automated trading the following Microsoft C# course will help you modify the starter kit cBot in this download to add new features for your own personal trading strategy.

Algorithmic Trading Facts

A significant number of traders venture into algorithmic trading with the misconception that they have discovered a foolproof strategy that guarantees effortless wealth. However, this notion is far from reality. It is crucial to read this article, as it can save you valuable time and money.

How To Install & Remove

First, make sure you have the cTrader trading platform installed and then simply unzip the file and double-click on it to automatically install it onto the platform.

Any Questions?

If you have any questions, please first search our coding help forum for the answer, if you cannot find it, post a new question.

Need Coding Help?

We can help you modify this cBot for your own personal trading strategy, contact our team for a quote.

Need a Broker

If you are still looking for a broker you can trust, take a look at our best cTrader broker site.