Indicator Overview

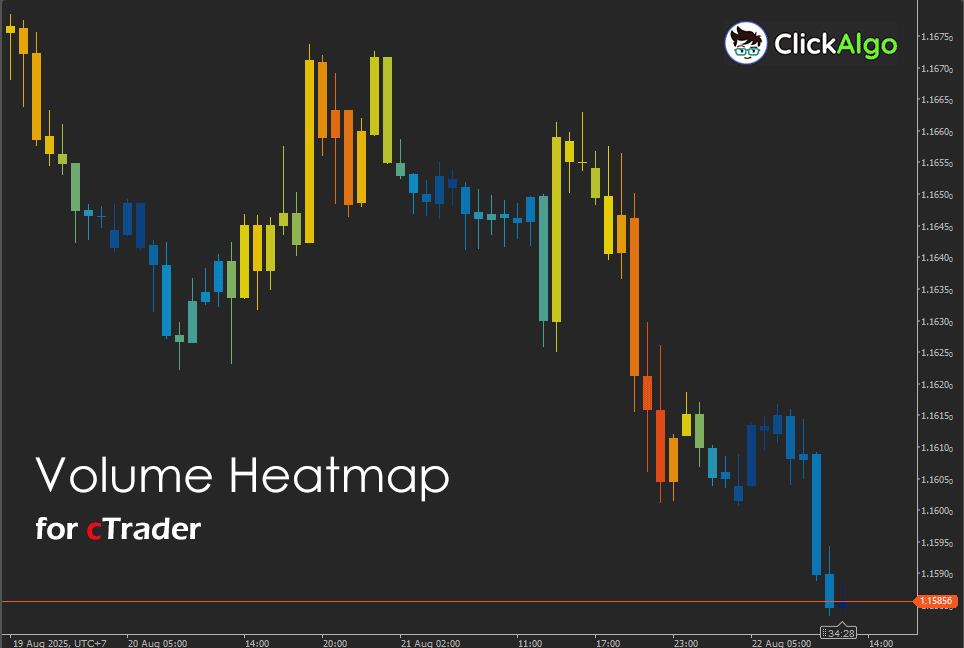

This overlay transforms raw tick volume into a continuous heat signal that blends into your candles. By normalising activity within a rolling window, it adapts across symbols and timeframes. A light EMA smooths flicker while preserving responsiveness, and optional alerts draw attention to unusually high or low participation. The result is an intuitive, low-clutter readout of market energy.

Background & History

Heat-based volume visuals grew from tape-reading and market microstructure research, where changes in participation often foreshadow moves or validate breakouts. As retail platforms exposed tick volume broadly, traders adopted percentile scaling to compare activity across different regimes. This indicator formalises that approach for cTrader with robust normalisation, smoothing, and clear colour mapping.

How the Indicator Works

The indicator gathers a rolling window of tick volumes, defines a lower and upper percentile band to frame “typical” activity, scales the current bar within that band, smooths the result with an EMA, then maps the intensity to colour and transparency before optionally recolouring the bar.

- Adaptive normalisation handles regime shifts by using rolling percentiles.

- EMA smoothing reduces flicker while remaining responsive.

- Palette and alpha controls tune visibility on light or dark charts.

- Thresholds power alerts for unusually high or low activity.

Key Features

A compact, configurable overlay that fuses participation information into the price bars you already read. Tunable sensitivity, palettes, transparency, and alerts let you fit the tool to your market and timeframe.

- Real-time bar colouring from smoothed volume intensity.

- Custom lower and upper percentile bounds.

- Multiple palettes, including greyscale and custom two-colour.

- Independent transparency ranges from subtle to bold overlays.

- Optional alerts for extremely high and low tick volume.

How to Use it for Trading (at a glance)

Use the heatmap to confirm breakouts when price expansion is accompanied by hotter bars, to fade stretched moves when heat dries up, and to avoid low-participation chop where signals have less edge. Around news or session opens, watch for abrupt transitions from cool to hot as a cue to adjust risk or time entries. Combine with VWAP, support-resistance, and trend filters to separate impulsive moves from hollow drifts.

Inputs & Parameters

These inputs control sensitivity, visibility, and alerting so the overlay matches your symbol, timeframe, and trading style.

| Parameter |

Default / Type |

Description |

| Inputs |

| Window |

200 (int) |

Bars used to compute percentile bounds for normalisation. |

| Smooth Period |

5 (int) |

EMA period applied to the scaled value to reduce flicker. |

| Enable Bar Coloring |

True (bool) |

Applies heat colour directly to price bars. |

| Normalization |

| Lower Percentile |

10.0 (double) |

Lower bound of the volume distribution for scaling. |

| Upper Percentile |

90.0 (double) |

Upper bound of the volume distribution for scaling. |

| Clamp Outliers |

True (bool) |

Clamps scaled values to the 0–1 range. |

| Palette |

| Palette |

BlueToRed (enum) |

Colour palette used to map intensity. |

| Low Color |

DodgerBlue (string) |

Custom colour for low intensity when using the custom palette. |

| High Color |

OrangeRed (string) |

Custom colour for high intensity when using the custom palette. |

| Min Alpha 0-255 |

160 (int) |

Minimum transparency level for cooler bars. |

| Max Alpha 0-255 |

255 (int) |

Maximum transparency level for hotter bars. |

| Levels |

| High Volume Threshold pctl |

95.0 (double) |

Percentile threshold used for high-volume alerts. |

| Low Volume Threshold pctl |

20.0 (double) |

Percentile threshold used for low-volume alerts. |

| Alerts |

| Enable Alerts |

False (bool) |

Master switch for alerts. |

| Alert on High Volume |

True (bool) |

Trigger when current volume ≥ high threshold. |

| Alert on Low Volume |

False (bool) |

Trigger when current volume ≤ low threshold. |

Formulas

The formula scales the current tick volume against a rolling percentile band, smooths it with an EMA, clamps it to the 0–1 range, and then maps the intensity to colour and transparency.

Given.

V = current bar tick volume.

Qlow = LowerPercentile of volumes over Window.

Qhigh = UpperPercentile of volumes over Window.

α = 2 / (SmoothPeriod + 1).

Scale. x = (V − Qlow) / (Qhigh − Qlow).

Clamp. x = Clamp(x, 0, 1).

Smooth. ema = α · x + (1 − α) · emaprev.

Intensity. I = Clamp(ema, 0, 1).

Colour mapping. colour = PaletteMap(I), alpha = MinAlpha + I · (MaxAlpha − MinAlpha).

Advantages

The overlay gives an immediate, context-aware read of participation on price, reducing the need for extra panes. Percentile normalisation adapts to changing volatility and liquidity regimes, while smoothing keeps the signal legible without heavy lag. Custom palettes and transparency let you set a subtle or emphatic look that works across themes.

Disadvantages

Tick volume is a proxy for actual traded volume, so precision varies by broker and symbol. Smoothing can delay the hottest colour transitions by a bar or two, and aggressive palette or alpha settings may visually dominate the chart. Relying on heat alone without confirming tools can lead to false inferences in thin markets.

How To Install & Remove

First, ensure that you have the cTrader trading platform installed. Then, unzip the file and double-click it to install the platform automatically.

Need Extra Help?

Get instant answers with cTrader Sensei — our free AI assistant built for the cTrader platform. It can explain the indicator settings, suggest trading strategies, and guide you step-by-step through this indicator. Rated 4.9 out of 5 in the ChatGPT Store.

Chat with cTrader Sensei

Prefer human help? Visit our support forum where our team and community can assist you.

Note: cTrader Sensei runs on OpenAI's ChatGPT platform. To use it, you will be asked to create a free OpenAI account. Registration is quick and costs nothing.

The free version works immediately, but upgrading to a ChatGPT Plus subscription unlocks the latest GPT model, which provides more accurate and detailed answers for trading, coding, and product support.

To upgrade, log in to ChatGPT, click your profile in the bottom left, and select Upgrade to Plus.

Need a Broker

If you're still looking for a broker with tight spreads and fast execution, visit our top cTrader broker site.