Overview

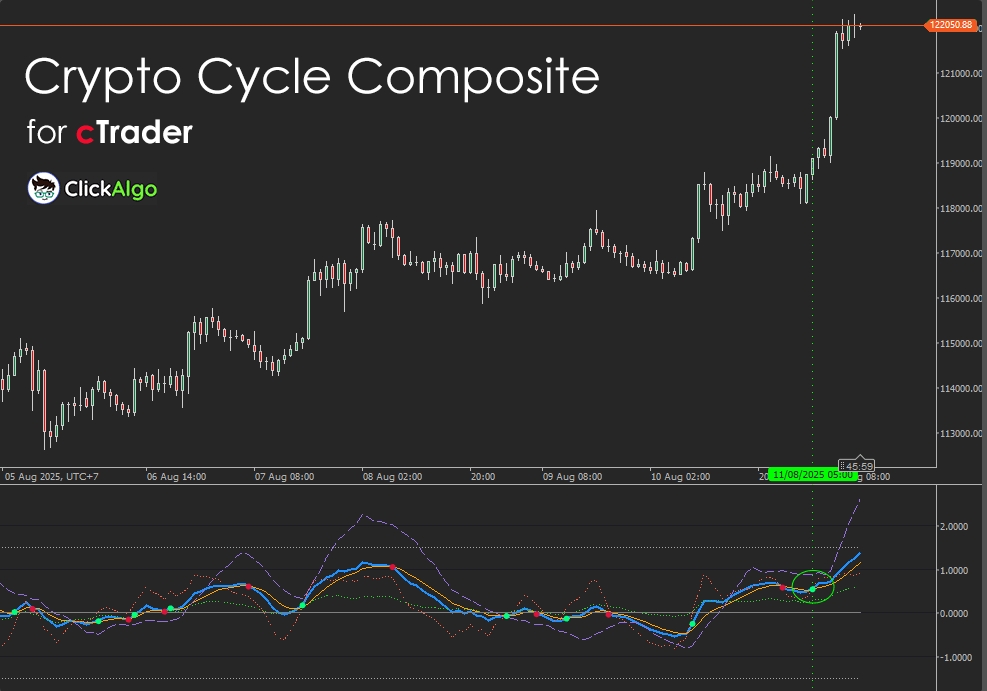

Crypto markets are notoriously volatile, cycling between accumulation, markup, distribution, and markdown phases at a rapid pace. The Crypto Cycle Composite condenses multiple momentum measurements into a single composite line, making it easier to detect when the market is shifting gears.

It draws three separate oscillators:

-

Band-Pass Z-Score — measures cyclical movement by subtracting a slow MA from a fast MA, then normalising it.

-

RSI Oscillator — a smoothed RSI mapped to ±1 for consistent scaling.

-

Stochastic Oscillator — %K line mapped to ±1 for straightforward comparison.

These are combined using your chosen weights and smoothed with an EMA to create the composite signal. Reference levels (±σ) and a zero line make it easy to see when momentum is extreme or neutral. Built-in point markers and optional alerts highlight key moments when the composite crosses its signal line or breaches the upper and lower levels.

How the Indicator Works

The Crypto Cycle Composite processes market data through three different momentum filters, each capturing a unique aspect of price movement. These components are normalised so they share the same scale, then blended according to your chosen weights to form a single, balanced reading. The result is a smooth composite line that reacts quickly to changes while filtering out excess noise, supported by visual levels and alerts for clearer trade decisions.

1. Band-Pass Filter

2. RSI Oscillator

3. Stochastic Oscillator

4. Composite Calculation

5. Alerts and Levels

-

Draws horizontal reference lines at zero, upper, and lower levels.

-

Marks green/red points for level breaches and signal crosses.

-

An optional on-screen alert message.

Key Features

The key features for this type of custom indicator are as follows:

-

Combines three oscillators — Band-Pass, RSI, and Stochastic — into a single composite line.

-

Weight controls let you emphasise or ignore specific components.

-

Z-score normalisation for consistent scaling across markets and timeframes.

-

Adjustable upper and lower threshold levels in standard deviations.

-

EMA signal line for crossovers.

-

Visual alerts with green/red markers for level breaches and signal crosses.

-

Optional pop-up/log alerts when levels are crossed.

-

Works on all cTrader instruments, optimised for crypto assets.

How to Use it for Trading

The Crypto Cycle Composite can be applied in a variety of market conditions, from range-bound consolidation to strong trending phases. Its composite approach means you are not relying on a single momentum signal, but on a weighted combination of three proven tools. It can help with deciding when to enter a trade, checking if a breakout has real strength, spotting when price and momentum are out of sync, and recognising when the market is stretched too far in one direction. By following how the composite line moves in relation to its signal line and the set threshold levels, you can get a clearer sense of whether momentum is building, fading, or turning the other way.

-

Composite crossing Signal.

-

Composite crossing Upper Level or Lower Level.

-

Overbought/Oversold – Watch for breaches above the upper level or below the lower level.

-

Trend Change Signals – Look for crosses between the Composite and Signal lines.

-

Divergence – Spot when price makes a new high/low but Composite does not.

-

Weight Adjustments – Tune weights to prioritise momentum signals that fit your strategy.

Inputs & Parameters

The following are the indicator parameters that you can adjust.

| Parameter |

Default / Type |

Description |

| Inputs |

| Source |

Price Type |

Price type used for calculations (Close, Open, High, Low, Median, Typical, Weighted). |

| BandPass |

| Fast MA (bandpass) |

10 |

Short moving average period for band-pass calculation. |

| Slow MA (bandpass) |

48 |

Long moving average period for band-pass calculation. |

| RSI |

| RSI Period |

14 |

Length of RSI calculation. |

| RSI Smoothing |

5 |

EMA period applied to smooth RSI. |

| Stochastic |

| Stochastic %K |

14 |

%K period for Stochastic Oscillator. |

| Stochastic %D |

3 |

%D period for Stochastic Oscillator. |

| Stochastic Slowing |

3 |

Slowing factor for %K. |

| Normalization |

| Z-Score Lookback |

100 |

Lookback period for mean and standard deviation in BandPass normalisation. |

| Signal |

| Composite EMA (signal) |

5 |

EMA period used to smooth the composite line. |

| Weights |

| Weight: BandPass |

1.0 |

Influence of the Band-Pass component in composite calculation. |

| Weight: RSI |

1.0 |

Influence of the RSI component in composite calculation. |

| Weight: Stochastic |

1.0 |

Influence of the Stochastic component in composite calculation. |

| Levels |

| Upper Level (σ) |

1.5 |

Overbought threshold in standard deviations. |

| Lower Level (σ) |

-1.5 |

Oversold threshold in standard deviations. |

| Alerts |

| Enable Alerts |

True / False |

Enables pop-up/logging when levels or signal crossings occur. |

Crypto Cycle Composite Formula

The formula below describes how the indicator was calculated.

BandPass = SMA_Fast(Price) − SMA_Slow(Price)

BandPassZ = (BandPass − Mean(BandPass)) / StdDev(BandPass)

RSI_Osc = (EMA(RSI(Price)) − 50) / 50

Stoch_Osc = (%K − 50) / 50

Composite = (W_BP × BandPassZ + W_RSI × RSI_Osc + W_Stoch × Stoch_Osc) / (W_BP + W_RSI + W_Stoch)

Signal = EMA(Composite, SignalPeriod)

One disadvantage of the Crypto Cycle Composite is that it relies on several momentum-based components that can all react to price in a similar way during highly volatile or choppy markets. When crypto price action gets noisy and directionless, the band-pass, RSI, and Stochastic may all trigger conflicting or rapid signals, leading to whipsaws. In these conditions, the composite might produce too many false alerts unless the smoothing, weights, or levels are adjusted — meaning it can require some fine-tuning to suit different coins, timeframes, or volatility environments.

How To Install & Remove

First, ensure that you have the cTrader trading platform installed. Then, unzip the file and double-click it to install the platform automatically.

Need Extra Help?

Get instant answers with cTrader Sensei — our free AI assistant built for the cTrader platform. It can explain the indicator settings, suggest trading strategies, and guide you step-by-step through this indicator. Rated 4.9 out of 5 in the ChatGPT Store.

Chat with cTrader Sensei

Prefer human help? Visit our support forum where our team and community can assist you.

Note: cTrader Sensei runs on OpenAI's ChatGPT platform. To use it, you will be asked to create a free OpenAI account. Registration is quick and costs nothing.

The free version works immediately, but upgrading to a ChatGPT Plus subscription unlocks the latest GPT model, which provides more accurate and detailed answers for trading, coding, and product support.

To upgrade, log in to ChatGPT, click your profile in the bottom left, and select Upgrade to Plus.

Need a Broker

If you're still looking for a broker with tight spreads and fast execution, visit our top cTrader broker site.