Innovation Through Machine Learning

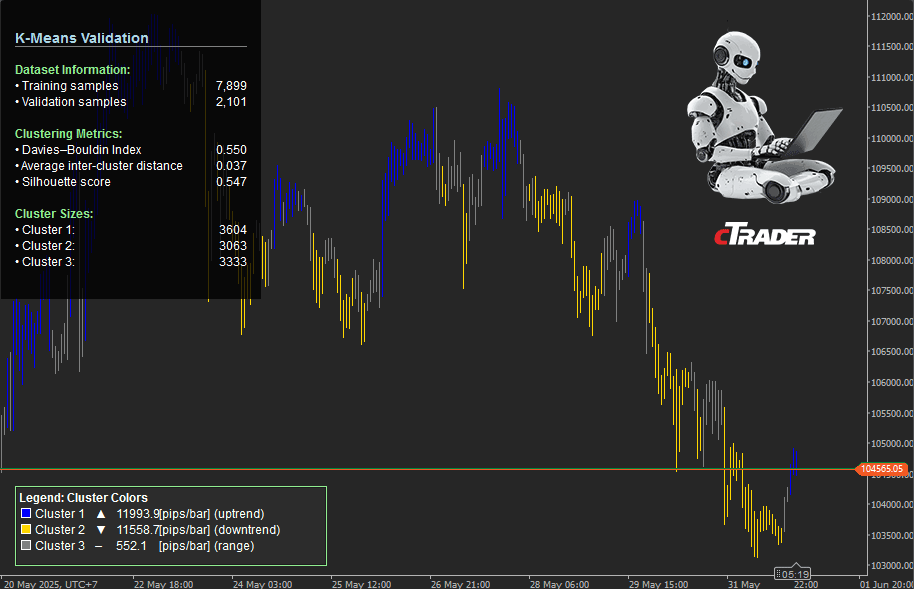

At the core of our system lies machine learning, a technology that allows the algorithm to analyse and learn from historical and current market patterns. This process yields highly accurate and timely predictions, providing traders with critical insights for informed and strategic decision-making. Using key data from technical indicators such as RSI, ADX, and ATR, the system performs a thorough analysis of market trends and movements. This meticulous analysis provides an in-depth understanding of market dynamics, enabling the development of more effective and data-based trading strategies.

Created by Walter from Finwalt Trading

Provided to ClickAlgo's customers for free.

Important This product can only be used on one chart at a time due to the computational resources involved. If you add it to multiple charts, it may not function correctly.

Dynamic Adaptation and Continuous Learning

Benefiting from machine learning, the system constantly adapts and evolves in response to market changes. This ability to learn and continuously improve ensures that the system remains practical and relevant, regardless of market variations.

Enhanced Security and Guaranteed Reliability

We incorporate rigorous security measures and a robust license validation process, ensuring that only authorised users have access to the system's advanced functions. This approach guarantees a safe and highly reliable trading environment.

Custom Optimisation for Various Trading Scenarios

The system is exceptionally versatile, efficiently handling two, three, or more data sets (clusters). Its design allows for extensive customisation, adapting to the specific needs and preferences of each trader. In conclusion, this system represents a comprehensive solution for traders looking to capitalise on the power of machine learning to enhance their market performance. With this system, you are equipped to navigate the complex world of trading with greater security and effectiveness. Transform your trading approach with our cutting-edge machine-learning technology!

Colouring Process of the Indicator

The initial colouring of the indicator is a fundamental aspect, established during the initialisation phase and based on indices preceding the current ones. Within a one-hour timeframe, the update of the colouring is synchronised with the completion of this period. It's essential to note that historical candles are not suitable for traders seeking strategies with outdated clusterizations, as they do not reflect current trading opportunities. Additionally, the implemented code, in line with the guidelines of the guide and already integrated into the system, will restrict new colouring. This limitation may hinder access to future trading opportunities, particularly if license validation is required.

Indicator Behaviour Outside of Trading Sessions

Regarding the indicator's behaviour during periods when trading sessions are not conducted, it has been noted that it displays the message "Loading data and training model". This message is part of the indicator's initialisation method and will remain visible until the calculation process is active or until Forex trading resumes. This behaviour is a standard response of the system to trading inactivity.

Comment on Limiting Clusters to 6

I have decided to limit the number of clusters to 6 to ensure that a reduced number of them is effective in any situation and time frame. This limitation ensures that each cluster has enough data to be statistically robust. This is particularly important for the value associated with the historical true range and for the effectiveness of the K-means model in correctly identifying each cluster, avoiding leaving any with a null value.

Rationale Behind the Choice of 6 Clusters

The choice of 6 clusters is logical and feasible. This number allows for segments 2, 3, or 4 signals per bullish or bearish trend. In doing so, it avoids overwhelming the user with excessive information and reduces the hesitation that may arise when observing an excessive number of clusters in real-time.

Considerations on Clustering and Data Quality

A higher number of clusters could increase the probability that the clustering is not effective for each one. This is because, as the number of clusters increases, some might end up capturing simply market noise, which would decrease the precision and utility of the clustering. This observation highlights the importance of striking a balance between the number of clusters and the quality of the data obtained.

Maximum Timeframe

In Forex, the indicator can support other financial markets, such as cryptocurrencies, stocks, and commodities, but is preferable due to the abundance of Forex data to focus on the Forex market.

How To Install & Remove

First, ensure that you have the cTrader trading platform installed. Then, unzip the file and double-click on it to automatically install it on the platform. The file that is installed can be found in your indicators folder.

Any Questions?

If you have any questions, please first search our product help forum for the answer. If you cannot find it, post a new question.

Need a Broker

If you are still looking for a broker you can trust, take a look at our best cTrader broker site.