History and Background

Candlestick charting dates back to the 18th century in Japan. It is often linked to rice merchant Munehisa Homma, who observed recurring relationships between opening, high, low, and closing prices. These recurring shapes were eventually given names such as engulfing bars, stars, and pin bars, each thought to signal possible changes in buying and selling pressure. Traders have leaned on these patterns for decades because they compress a lot of order flow into simple shapes. The Pattern Recognition Oscillator wraps a small library of them into one stream, so rather than hunting patterns by eye, you get a steady readout of pressure building or fading.

How the Indicator Works

On every bar, the indicator checks for the following, applies your weights, then nets the bull and bear points:

-

Engulfing, bullish and bearish

-

Harami, bullish and bearish

-

Piercing line and dark cloud cover

-

Pin bars, hammer or shooting star

-

Morning star and evening star

-

Doji, treated as neutral with a nudge toward the side of the close

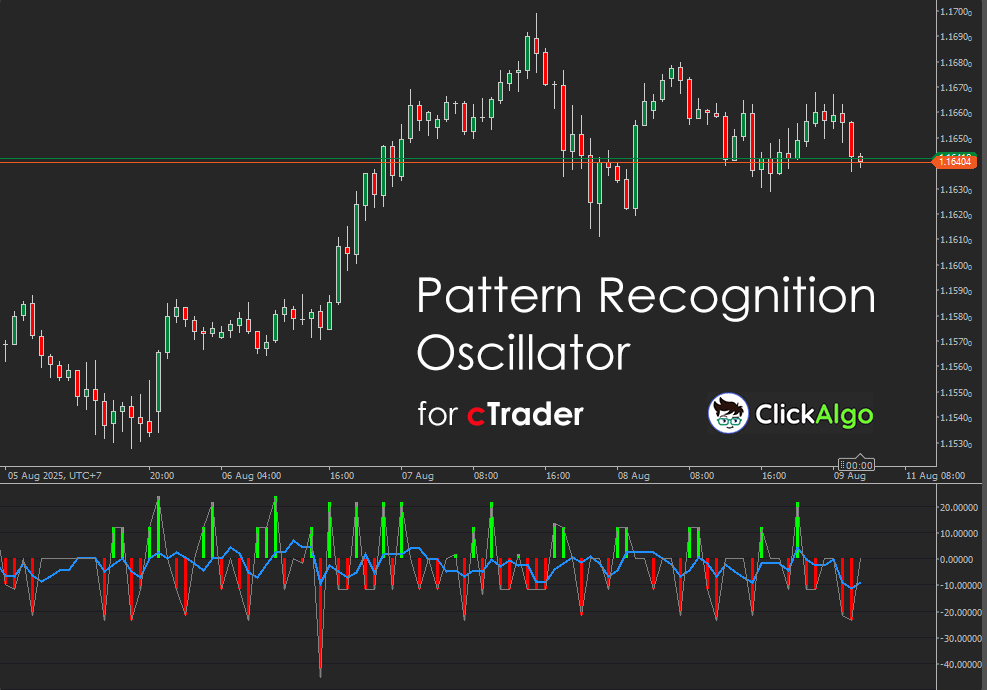

The raw score is scaled to minus one hundred to plus one hundred using the sum of all enabled weights. A simple moving average of the raw score forms the blue signal line. Green histogram bars plot bullish pressure, red histogram bars plot bearish pressure.

Key Features

The key features for this type of custom indicator are as follows:

- Multi-pattern engine, scans stars, pins, engulfing, harami, piercing, dark cloud, and doji.

- Normalised score, always plotted on the same scale for fast comparison.

- Weight control, turn patterns up or down, disable any you do not trust.

- Gap tolerance, gentle handling of small open gaps on symbols with coarse ticks.

- Signal line smoothing helps separate thrust from wiggle.

- Clear bull and bear histograms, green for accumulation, red for distribution.

How to Use it for Trading

Reading the oscillator

-

Zero line, above zero means bulls have the upper hand, below zero means bears have it.

-

Extremes, sustained readings above plus sixty suggest strong buying pressure, readings below minus sixty suggest strong selling pressure.

-

Crosses, the raw score crossing above the signal line can mark a fresh push, crossing below can flag fading momentum.

-

Divergence, price makes a new swing while the oscillator fails to confirm, which can tip you off to exhaustion.

Setups and filters

-

Trend plus timing, use a slow EMA on price as a compass, take longs when price is above the EMA and the oscillator turns up from below zero or crosses its signal line, flip the logic for shorts.

-

Breakout confirmation, when price breaks a recent high, look for the oscillator above zero and rising, for breakdowns, below zero and falling.

-

Pattern focus, if your market respects specific patterns, raise their weights and lower the rest to cut noise.

Stops and exits

-

Consider the opposite extreme as a soft exit signal, a long can be trimmed when the oscillator peaks above plus eighty, then turns, likewise a short when it bottoms below minus eighty, then turns.

-

A simple rule is to trail behind recent swing points while the raw score remains on your side of zero.

Inputs & Parameters

The following are the indicator parameters that you can adjust.

| Parameter |

Default |

What it does |

| Min Body % of Range |

0.25 |

Minimum body size as a share of the bar range for pin bar checks, prevents counting near doji bodies as pins. |

| Doji Body % of Range |

0.10 |

If body is at or below this share of range the bar is treated as a doji, a small directional nudge is applied based on close versus mid price. |

| Pin Bar Wick to Body Min |

2.5 |

Minimum wick to body ratio for a valid hammer or shooting star. |

| Gap Sensitivity, points |

0 |

Tolerance for tiny gaps in engulfing, piercing, and dark cloud checks, useful on symbols with larger tick sizes. |

| Weights, Engulfing, Harami, Piercing, Pin Bar, Morning or Evening Star, Doji |

22, 12, 18, 20, 24, 6 |

Relative impact of each pattern on the score, set any to zero to disable that pattern. |

| SMA Smoothing Period |

5 |

Length of the signal line that smooths the raw score. |

Pattern Recognition Oscillator Formula

The formula below describes how the indicator was calculated.

bull_points = sum of enabled bullish patterns on bar i, using your weights

bear_points = sum of enabled bearish patterns on bar i, using your weights

max_weight = sum of all enabled pattern weights

raw[i] = 100 × (bull_points − bear_points) ÷ max_weight

signal[i] = SMA(raw, SmoothPeriod)

bull_hist[i] = max(0, raw[i])

bear_hist[i] = min(0, raw[i])

Patterns can cluster during choppy sessions and the score can whipsaw around zero, reduce the weight of patterns that fire too often on your symbol, use a trend filter or expand the smoothing period to settle the stream, and never rely on a single tool for entries or risk control.

How To Install & Remove

First, ensure that you have the cTrader trading platform installed. Then, unzip the file and double-click it to install the platform automatically.

Need Extra Help?

Get instant answers with cTrader Sensei — our free AI assistant built for the cTrader platform. It can explain the indicator settings, suggest trading strategies, and guide you step-by-step through this indicator. Rated 4.9 out of 5 in the ChatGPT Store.

Chat with cTrader Sensei

Prefer human help? Visit our support forum where our team and community can assist you.

Note: cTrader Sensei runs on OpenAI's ChatGPT platform. To use it, you will be asked to create a free OpenAI account. Registration is quick and costs nothing.

The free version works immediately, but upgrading to a ChatGPT Plus subscription unlocks the latest GPT model, which provides more accurate and detailed answers for trading, coding, and product support.

To upgrade, log in to ChatGPT, click your profile in the bottom left, and select Upgrade to Plus.

Need a Broker

If you're still looking for a broker with tight spreads and fast execution, visit our top cTrader broker site.