History and Background

Volume Weighted Average Price, or VWAP, migrated from the execution desks of large institutions into retail trading for a simple reason: it balances price movement with participation. Classic VWAP gives you the session's average price weighted by volume, which helps judge fair value and mean reversion. This Intraday VWAP Bands variant goes a step further, wrapping VWAP with adaptive bands that respond to real participation, so you can see when price is stretched relative to current flow rather than a fixed distance.

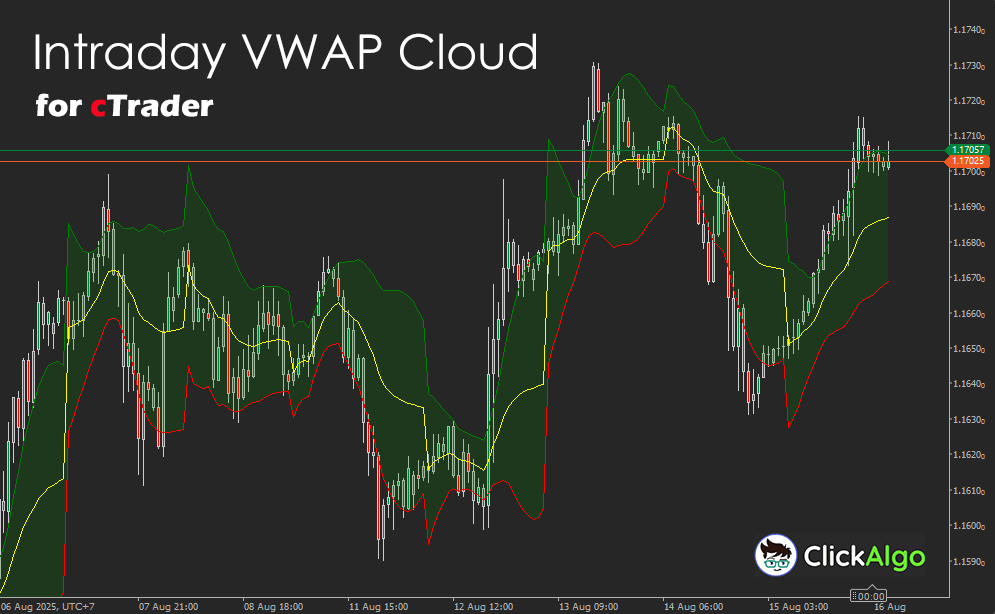

How the Indicator Works

The indicator maintains a running intraday VWAP that resets at the start of each new trading day. Around this VWAP, it builds dynamic upper and lower bands based on a volume-weighted standard deviation measured over a rolling intraday window, defined in minutes. That raw volatility measure is then smoothed with a simple moving average to stabilise the bandwidth. The result is a responsive fair value line with adaptive envelopes that widen when participation rises and tighten when the tape is quiet, giving clean context for mean reversion, breakouts, and pullbacks.

Key Features

The Intraday VWAP Bands are designed to give traders a sharper view of market balance by combining price, volume, and volatility into a single framework. Instead of relying on static levels, the bands expand and contract in real time with actual market participation, offering a more reliable context for trade entries, exits, and risk management across intraday sessions.

-

True session VWAP – resets daily, ensuring your trading anchor reflects the current session’s real flow.

-

Adaptive volatility bands – expand and contract with volume-weighted standard deviation, showing when price is stretched or balanced.

-

Smoothed band width – reduces noise during thin liquidity, giving a clearer picture of market extremes.

-

Instant visual context – cloud shading between bands makes overextended moves easy to spot at a glance.

-

Versatile across markets – works on forex, indices, commodities, and crypto with intraday timeframes.

How to Use it for Trading (at a glance)

The Intraday VWAP Bands can be applied as both a mean-reversion and trend-continuation tool, depending on market conditions. By framing price action against the daily VWAP and its adaptive envelopes, traders gain a clear sense of when the market is fairly priced, when it is stretched to extremes, and when momentum is strong enough to break away from value. This makes the indicator a versatile companion for scalpers, day traders, and swing traders working on intraday timeframes.

-

Mean reversion bias near the outer band, look for rejection wicks, momentum fade, or a return through VWAP to confirm

-

Pullback entries in trends, use the side of VWAP aligned with the trend as a dynamic value area, buy pullbacks above VWAP in uptrends, sell pullbacks below VWAP in downtrends.

-

Breakout confirmation, closes outside a widening band with sustained distance from VWAP suggests expansion, avoid fading the first impulse without a clear reversion trigger.

-

Session awareness, VWAP resets at the daily boundary, treat each day as a fresh distribution.

-

Risk framing, stops can sit beyond the band that invalidates your idea, targets can be VWAP reversion or opposite band, depending on volatility.

Inputs & Parameters

All configurable parameters are listed below. The defaults are suitable starting points, but you can fine-tune the weights and thresholds to match different markets or trading styles.

| Parameter |

Default / Type |

Description |

| Inputs |

| VWAP Period (minutes) |

500 (int) |

Rolling lookback window in minutes used to calculate the local VWAP and volume-weighted standard deviation within the session. |

| Bands |

| Upper Multiplier |

2.0 (double) |

Number of smoothed standard deviations added above VWAP to plot the upper band. |

| Lower Multiplier |

2.0 (double) |

The number of smoothed standard deviations is subtracted from VWAP to plot the lower band. |

| Smoothing |

| Smoothing Period |

10 (int) |

A simple moving average period is applied to the standard deviation series to stabilise bandwidth and reduce noise. |

Formula

The Intraday VWAP Bands are built on a daily VWAP anchor with adaptive envelopes derived from volume-weighted volatility. The formulas below outline exactly how the fair value line and its dynamic bands are calculated.

Let TPt = (Hight + Lowt + Closet) / 3 be the typical price for bar t, and Vt the tick volume.

Intraday VWAP (resets each new trading day):

VWAPt = Σi ∈ today, i ≤ t (TPi × Vi) ÷ Σi ∈ today, i ≤ t Vi

Local mean over rolling window W (minutes):

μt = Σi ∈ Wt (TPi × Vi) ÷ Σi ∈ Wt Vi

Volume-weighted standard deviation:

σt = √( Σi ∈ Wt Vi × (TPi − μt)² ÷ Σi ∈ Wt Vi )

(with a minimum floor set at the instrument pip size)

Smoothed deviation:

σ̃t = SMAP(σt)

Upper and Lower Bands:

Uppert = VWAPt + UpperMult × σ̃t

Lowert = VWAPt − LowerMult × σ̃t

Advantages

Unlike fixed distance envelopes, these bands breathe with actual participation, the standard deviation is volume weighted then smoothed, so you retain responsiveness without jitter. The daily reset keeps the context aligned with the current session, which suits intraday traders who anchor decisions to today’s flow.

Disadvantages

VWAP is session centric, strong trend days can hug one band for extended periods, fading without a proper trigger can be costly. Tick volume quality varies by symbol and broker, which can slightly alter band width across feeds.

How To Install & Remove

First, ensure that you have the cTrader trading platform installed. Then, unzip the file and double-click it to install the platform automatically.

Need Extra Help?

Get instant answers with cTrader Sensei — our free AI assistant built for the cTrader platform. It can explain the indicator settings, suggest trading strategies, and guide you step-by-step through this indicator. Rated 4.9 out of 5 in the ChatGPT Store.

Chat with cTrader Sensei

Prefer human help? Visit our support forum where our team and community can assist you.

Note: cTrader Sensei runs on OpenAI's ChatGPT platform. To use it, you will be asked to create a free OpenAI account. Registration is quick and costs nothing.

The free version works immediately, but upgrading to a ChatGPT Plus subscription unlocks the latest GPT model, which provides more accurate and detailed answers for trading, coding, and product support.

To upgrade, log in to ChatGPT, click your profile in the bottom left, and select Upgrade to Plus.

Need a Broker

If you're still looking for a broker with tight spreads and fast execution, visit our top cTrader broker site.