Why Forex Traders Lose Money

It is a fact that more than 90% of new traders will give up and lose money during the first 2 years of trading, just read this article which will prevent you from making the common mistakes that cause this. The fact is that over 50% of traders make money, but they do not follow strict trading rules and they let their emotions take over. Another major reason is false expectations and inadequate preparation!

They lose more money on their losing trades than they make on their winning trades.

Cut Losses, Let Profits Run – Why is this So Difficult to Do?

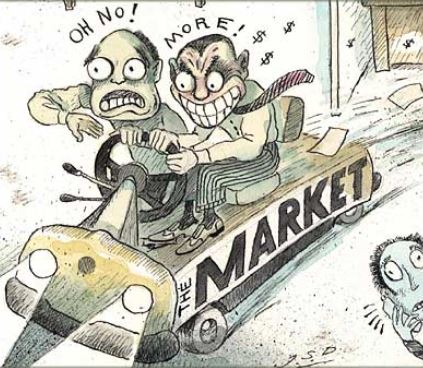

Human Emotions Play a Big Part

Prospect Theory: Losses Typically Hurt Far More than Gains Give Pleasure

Fear, Greed, Reactive Behaviour Pattern

Some people are more emotional than others, trading requires the person to follow a strict set of trading rules and to never break them, the problem is that these trade rules are broken time and time again causing financial losses or winning trades closing early.

Disposition Effect: Holding on to losers for too long and selling winners early.

Chasing Losses

This is a major problem, how many times have you found yourself in the following situation.

- The days trading is going well, you have hit your daily target of £100.00

- You just enter one more position

- The position goes against you and you are £10.00 down, you wait to see if it rises

- The position goes against you further and you are £50.00 down

- You close the position at a £50.00 loss and you enter a new position

- The new position goes against you and you are £150.00 down

- Your emotions take over and you start to sweat, you have lost your daily gain and are now £50.00 down from the day's target

- You start to chase your losses to at least break even or make back the money you have lost

- You will lose more money, you will get stressed, this is a very dangerous place to be.

Forex Trading Hard Facts

It is a fact that more than 90% of new traders will give up and lose money during the first 2 years of trading, just read this article which will prevent you from making the common mistakes that cause this.

What About Natural Talent?

It is well known that there are Forex traders with natural talent that can make large amounts of consistent money, take for example a 20-year old man who has been getting £200,000 every year with only 4-years of experience.

How Can We Help You Succeed?

Until you are a hardened trader with rock-solid emotions, you need to perhaps automate some or all of your manual trading style, this can be achieved by asking us to develop the strategy for you. Algorithmic Trading is the process of using computers programmed to follow a defined set of instructions for placing a trade in order to generate profits at a speed and frequency that is impossible for a human trader and to trade for you while you are not in front of your screen, this is perfect for part-time traders.

Watch This Excellent Video

These two videos have been hand-picked to help you succeed.

Calm Trader: Win in the Stock Market without Losing Your Mind

"Benefit from someone with more than 20 years experience"

Steve has done the research so you don't have to. Each of these fourteen principles is part of what has made him successful for more than two decades.

This was one of the most amazing books I've ever read on trader psychology. I felt extremely inspired after reading each chapter in this book. Not only was it short and to the point, but it kept me engaged the whole time. It is true that succeeding in the markets is in (1/3) logic and (2/3) psychology. This is another winner in Steve's arsenal of published books. And for only $2.99, you are doing yourself a disservice by not giving it a try.

What are The Golden Rules For Every Trader?

Our Programming Services

We offer a Professional Programming Service for the cTrader trading platform