Introduction to ADX

ADX (blue line) is plotted as a single line with values ranging from a low of zero to a high of 100. ADX is non-directional; it registers trend strength whether the price is trending up or down. The indicator is usually plotted in the same window as the two directional movement indicator (Di+ and Di-) lines, from which ADX is derived.

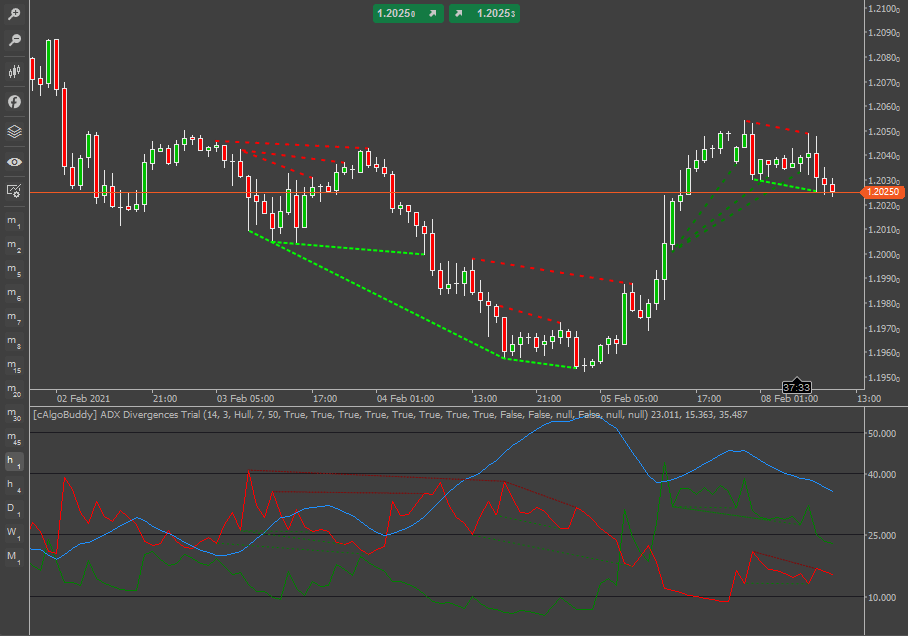

This indicator spots divergences on Di+ and Di- lines. In contrast to other indicators that spot divergences, with this one, we can extract more valuable information from the other 2 counterparts of a divergence signal. For example, if a divergence happens on Di+, we can evaluate the signal taking into account the Di- and ADX levels.

The Di+ and Di- lines are partially smoothed with a Hull moving average on 3 periods. For a 100% divergence frenzy, you can set the MA period to 1 and the moving average type to Simple. However, since we draw divergences on 2 lines in the same indicator window, sometimes you might feel overwhelmed by the signals. On the other hand, you can select from the indicator settings exactly which types of divergences you want to see and for which line (Di+ or Di-).

A divergence signal is considered confirmed at the opening of the bar following a divergence. However, due to the “inflexible” nature of the ADX trend lines (in comparison to, let’s say RSI) whenever a divergence line appears, it will probably stay there until the confirmation bar, unless extreme volatility occurs.

Before trading any divergence signal, identify the following:

- Direction and level of ADX

- Distance between Di+ and Di-

- Direction and level of Di+

- Direction and level of Di-

Also, keep in mind

- Avoid taking any divergence trade when the ADX is low (lower than 15 and falling trend), as the signals should be taken based on already developed or developing trends.

- Also, keep in mind that the crossing of Di+ and Di- is considered a bullish/bearish signal in itself, so modify your positions accordingly.

- In case both Di+ and Di- diverge on the same candle, choose the better corresponding line depending on the trend (Bullish trend/bullish signal Di+, Bearish trend/bearish signal Di-).

- You don’t have to trade every signal.

Divergences on DiPlus

DiPlus (Green) is the line that plots the bullish trend strength. We can spot divergences between the bullish trend strength in a similar way with most oscillators.

Regular Bullish Divergence

Definition: The price made a lower low but the indicator made a higher low. The ideal outcome is: After a minor bullish bump, we should see a bearish trend developing. Plotted with a dotted light green line in the price and indicator windows.

A dominant bearish trend that is starting to develop or is already developed. We go short after the small correction has happened. In some cases, the divergence on Di+ can happen on a bearish candle, a good confirmation of the dominant bearish trend.

Occasionally, the bullish bump will develop a bullish trend. This can happen when there is little to no trend (Di+ and Di- are close to each other, ADX< 20) or after bearish trend exhaustion on resistance levels.

Hidden Bullish Divergence

Definition: The price made a higher low and the indicator made a lower low. We should expect a bullish trend development or continuation. Plotted with a partially dotted dark green line in the price and indicator windows.

A dominant bullish trend that is starting to develop or is already developed. We go long after the small correction has happened. Stop-loss should be placed around the Low of the divergence candle.

One of the better signals of this indicator, mainly because we expect immediate trend continuation and we can keep our stop losses to a minimum.

Regular Bearish Divergence

Definition: The price made a higher high but the indicator made a lower high. After a minor bearish dip, we should see a bullish trend developing. Plotted with a dotted dark red line in the price and indicator windows.

A dominant bullish trend is still on the rise (ADX still rising on divergence time).

The circumstances for this scenario to happen are very rare since Di+ represents bullish strength. Usually, the circumstances will happen after the bullish trend has been exhausted, meaning that it is the final “peak” before the bearish trend will start to develop. So, most of the time it is recommended to go short on this signal.

Hidden Bearish Divergence

Definition: The price made a lower high and the indicator made a higher high. We should expect a bearish trend continuation. Plotted with a partially dotted red line in the price and indicator windows.

A dominant bearish trend with bullish spikes (ADX still rising on divergence time).

Asking for a bearish trend continuation from the bullish trend line is counterintuitive, this is why this signal should be taken very cautiously. Often, the market will enter a consolidation phase after this divergence.

In a trendless market, avoid taking a trade. In an exhausted bearish trend, if you choose to go short, scalp the trade.

Divergences on DiMinus

DiMinus (Red) is the line that plots the bearish trend strength. The way we spot divergences on price and DiMinus is somehow a reverse of the way we spot divergences on DiPlus.

Regular Bullish Divergence

Definition: The price made a lower low but the indicator made a lower high (instead of a higher low). After a minor bullish bump, we should see a bearish trend developing. Plotted with a dotted light green line in the price window and a dotted dark red line in the indicator window.

A dominant bearish trend that is starting to develop or is already developed. We go short after the small correction has happened. In some cases, the divergence on Di- can happen on a bearish candle, a good confirmation of the dominant bearish trend.

Just like the signal coming from the Di+ counterpart, sometimes the bearish bump will develop a bearish trend. This can happen when there is little to no trend (Di+ and Di- are close to each other, ADX< 20) or after bullish trend exhaustion on resistance levels.

Hidden Bullish Divergence

Definition: The price made a higher low and the indicator made a higher high (instead of a lower low). We should expect a bullish trend continuation. Plotted with a partially dotted green line in the price window and a partially dotted dark red line in the indicator window.

It’s counterintuitive to ask for a bullish trend continuation from the Di- trend line. We need to have bearish spikes in a bullish trend.

Regular Bearish Divergence

Definition: The price made a higher high but the indicator made a higher low (instead of a lower high). After a bearish dip in the price, we should see a bullish trend continuity. Plotted with a dotted dark red line in the price window and a dotted light green line in the indicator window.

It is recommended, in a strong and developing bullish trend to go long. But, in an exhausting and spent bullish market, go short.

Hidden Bearish Divergence

The price made a lower high and the indicator made a lower low (instead of a higher high). We should expect a bearish trend continuation. Plotted with a partially dotted red line in the price window and a partially dotted green line in the indicator window.

One of the better signals of this indicator, mainly because we expect immediate bearish trend continuation and we can keep our stop losses to a minimum. Stop-loss should be placed at the Low of the divergence candle.

Instant Telegram Message Alerts

Given that you have a bot and a channel set up in Telegram, the ADX Divergences indicator will send you messages for confirmed signals on the currency pair that you run it onto. Keep in mind that you will get signals only for the ones that you have selected "Yes" for display. You can configure this trading robot to also send instant Telegram alerts directly to your PC, Tablet or mobile phone.

IMPORTANT: Please make sure that your Time Zone is correctly adjusted to your local time (bottom right corner of the application).

Desktop Alerts

If you select Yes, the ADX Divergences indicator will push a message box notification on confirmed signals on your personal desktop.

Email Alerts

For this functionality to work, you must first configure your cTrader to be able to send emails (Settings-> Email). If you select Yes, the ADX Divergences indicator will send an email on confirmed signals to the address that you have entered.

How To Install & Remove

First, make sure you have the cTrader trading platform installed and then unzip the file and double-click on it to automatically install it onto the platform.

Any Questions?

If you have any questions, please first search our product help forum for the answer, and if you cannot find it, post a new question.

Need a Broker

If you are still looking for a broker you can trust, take a look at our best cTrader broker site.

Need Coding Help?

If you need help creating your very own customised automated trading system, contact our development team for a quote.