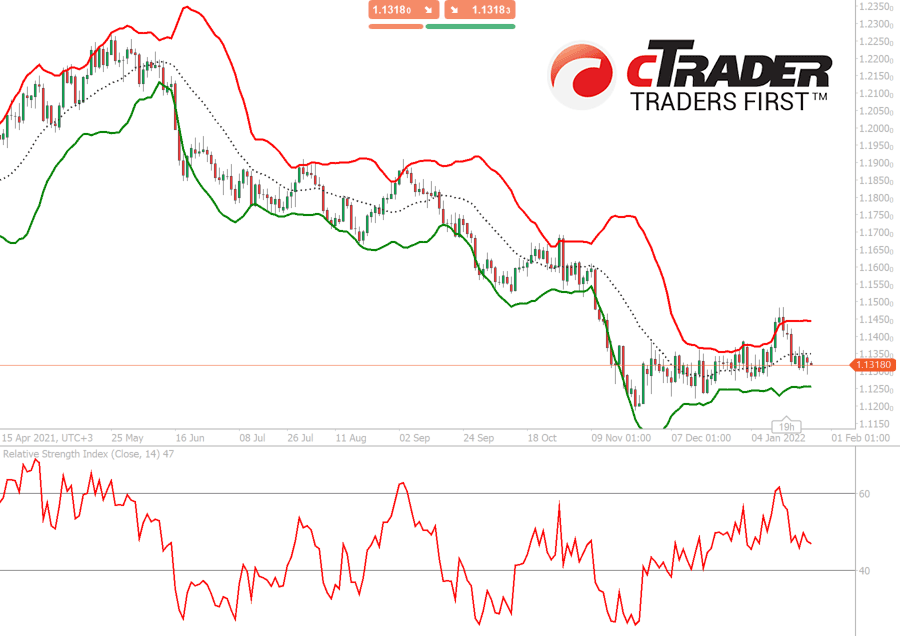

The Bollinger Bands - RSI strategy is a mean reversion strategy. It is based on the assumption that prices tend to return to the mean value after they reach specific overbought and oversold conditions.

How Does it Work?

Our strategy combines the information from two indicators, the Bollinger Bands and the RSI. It places trades when the price breaks the upper or lower Bollinger Bands and the RSI indicator is in an overbought/oversold area. For example, when the price breaks the upper Bollinger Bands and the RSI indicator is in an overbought area, then a Sell order is placed, assuming that the price will eventually correct itself and return to the moving average levels.

Besides the entry conditions, our strategy provides several exit options. You can choose the classic exit option and close the position when the price returns to the Bollinger Bands moving average but you can also use stop loss, take profit and trailing stop loss.

Bollinger Band Indicator

The Bollinger Band indicator is a trading tool used to determine entry and exit for your orders, the bands are used to determine overbought and oversold conditions. This indicator is included as a stock trading tool for the cTrader trading platform.

What Results Can It Achieve?

This automated trading system will open, close and manage your trades automatically, but we advise that you acquire the following skills below to protect your account against unpredictable market events.

- cBot optimisation.

- Not overfitting with optimisation.

- cBot backtesting.

- Trading system timing - when to turn on or off the cBot.

- Financial market knowledge, when to close trades early and let winners run.

Free Training on Demo Account

We will show you how to optimise settings for any symbol you wish to trade while using the 14-day free trial download and backtest to verify the results and we can also provide information on when to use different types of automated trading strategies.

Learn how to optimise and backtest any symbol, and define your risk vs reward.

How To Optimise Your Settings

This trading system will allow any symbol your broker supports, you will need to find suitable settings yourself, if you need help with doing this via optimisation just follow the link below.

Scalping Trading Strategy - Buy Trade

- Open a buy trade when the price touches a lower Bollinger band and the (RSI) stochastic oscillator is in the oversold zone.

- You can place your stop loss 10 pips below the level where you placed an order and If you think that this is too risky, you can calculate a distance between the middle and the lower Bollinger band.

- Close your buy trade when the price touches an upper Bollinger band.

cBot Adjustable Settings

This cBot has any settings and they are all explained below, if there is anything that you do not understand please follow the link below.

The Bollinger Bands comes with the following parameters

- Instance Name. You need to use a unique identifier for each instance of the cBot so that each instance operates on its own position only.

- Bollinger Bands.

- The Bollinger Bands indicator periods.

- Standard Deviation.The Bollinger Bands indicator standard deviation.

- Relative Strength Index.

- Periods. The RSI indicator periods.

- Overbought Level. The level marks the overbought area. When the RSI indicator is above this level, then the symbol is considered overbought.

- Oversold Level. The level marking the oversold area. When the RSI indicator is below this level, then the symbol is considered oversold.

- Risk Management.

- Trade Buy. When set to Yes, buy trades are allowed. When set to No, buy orders are not allowed.

- Trade Sell. When set to Yes, sell trades are allowed. When set to No, sell orders are not allowed.

- Volume Type.

- Balance Percentage. The percentage of balance to be risked on each trade.

- Equity Percentage. The percentage of the equity to be risked on each trade.

- Lots. The volume in Lots for each trade.

- Units. The volume in Units for each trade.

- Cash Amount. The cash amount is to be risked on each trade.

- Leverage. The Leverage is to be used for each trade.

- The volume value.

- Stop Loss. The stop loss for each trade in pips.

- Take Profit. They take profit for each trade in pips.

- Max Open Trades. The maximum number of open trades at any moment.

- Max Buy Trades. The maximum number of open buy trades at any moment.

- Max Sell Trades. The maximum number of open sell trades at any moment.

- Max Trades Per Day. The maximum number of trades to be placed each day.

- Max Spread. The spread in pips allowed for an order to be placed. If the spread exceeds the specified value in pips, the signal will be ignored.

- Max Slippage. The maximum slippage allowed for each order. If the slippage exceeds the max slippage, the order will be partially filled.

- Close on Reversal. When set to yes, positions are closed when there is a signal in the opposite direction.

- Trailing Stop Loss.

- Use Trailing Stop Loss. When set to yes, the Trailing Stop Loss feature is used.

- Trigger (pips). The position pips will trigger the trailing stop loss. When the trigger pips are reached, the position stop loss will be moved x pips behind the current symbol price, as defined by the Distance (pips) parameter.

- The distance in pips at which the stop loss will trail.

- Telegram Notifications.

- Send Telegram Notifications. When set to yes, the Telegram notifications are sent. Telegram notifications are sent when a position is opened or closed and when a signal occurs.

- Bot Token. The bot token is used for your telegram service.

- Chat ID. The chat ID is used for your telegram service.

How To Install & Remove

First, make sure you have the cTrader trading platform installed and then unzip the file and double-click on it to automatically install it onto the platform.

Any Questions?

If you have any questions, please first search our product help forum for the answer, if you cannot find it, post a new question.