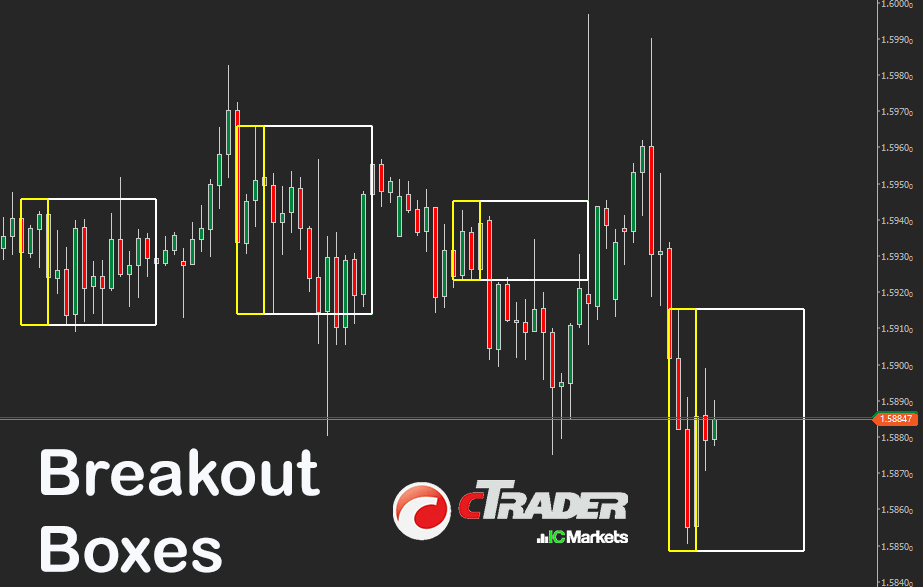

The breakout box indicator for cTrader emerges as a valuable tool within the forex market and as an advanced indicator, it effectively recognizes and automatically outlines a rectangular box around key support or resistance zones. This feature enables traders to identify potential breakout opportunities more efficiently, enhancing their decision-making process during trading activities.

The indicator focuses on conducting technical analysis specifically on timeframes shorter than 4 hours. It refrains from drawing rectangle boxes on timeframes exceeding 1 hour. It is important to note that the breakout box indicator demonstrates optimal performance when utilized within the 1-hour timeframe. Moreover, this versatile indicator can be seamlessly integrated into various trading styles, including scalping, day trading, and intraday trading. By accommodating different trading approaches, it offers traders the flexibility to adapt the indicator to their preferred strategies and timeframes.

How to Trade a Breakout?

A breakout box formation arises when the price of an asset becomes confined within two parallel levels of support and resistance. Before confirming the presence of a box set-up, it is crucial to ensure that both levels have been tested at least twice. This requirement helps to validate the reliability of the pattern. The underlying psychology behind the breakout box pattern revolves around a struggle between the bulls (buyers) and bears (sellers). During this period, neither side of the market demonstrates dominance, resulting in a state of equilibrium. This signifies a temporary balance where supply and demand forces are relatively equal, creating a period of consolidation and indecision in the market.

In your trading strategy, we execute trades when the price successfully breaks out of the box formation in one direction and subsequently retraces to "retest" the level it previously breached. This retracement is commonly referred to as a pullback. To effectively capitalize on these pullbacks, it is essential to have a comprehensive understanding of how they are traded. If you find yourself unsure about the intricacies of pullback trading, we recommend revisiting the earlier chapters that cover the generation of pullback entry signals. By reinforcing your understanding of pullbacks, you will be better equipped to apply this important concept in our trading approach.

- A breakout of the box presents a promising trading opportunity that arises when the price of an asset surpasses a resistance level or falls below a support level, accompanied by a notable increase in trading volume.

- To engage in breakout trading effectively, it is crucial to initially identify prevailing price trend patterns and determine the key support and resistance levels. This analysis will enable you to establish potential entry and exit points for your trades.

- Once you have implemented a breakout strategy and entered a trade, it is essential to have predefined criteria for managing potential losses. If the breakout fails to gather momentum or encounters resistance, it is crucial to cut your losses and re-evaluate the market conditions.

- Maintaining emotional discipline is paramount in any technical trading strategy. It is important to adhere to your predetermined plan, sticking to your entry and exit points. By doing so, you can avoid making impulsive decisions based on emotions and enhance your chances of executing successful trades.

Adjustable Indicator Settings

There are a few basic settings for this indicator that allow you to set the breakout box start and end time for trading sessions, as well as the box period end time. These are defaulted to 3 AM to 6 AM and the box end time is 6 PM, you can experiment with different values, but remember to use the 24HR clock.

How To Install & Remove

First, make sure you have the cTrader trading platform installed and then simply unzip the file and double-click on it to automatically install it onto the platform.

Any Questions?

If you have any questions, please first search our product help forum for the answer, if you cannot find it, post a new question.

Need a Broker

If you are still looking for a broker you can trust, take a look at our best cTrader broker site.