The cTrader Aieden Trendline Breakout strategy is a breakout strategy. It assumes that prices tend to trade within an upper trendline / lower trendline converging wedge channel and then periodically break out of that wedge (by closing above the upper trendline or below the lower trendline) when they initiate a change in trend direction. Entering a trade at that breakout point has been proven to be an effective trading strategy.

Our strategy uses the Aieden Trendline Breakout indicator (included). This is an indicator that draws both upper and lower trendlines around your asset prices, configured to converge at some point in the future based on the asset movements. As your price breaks out of the upper or lower trendlines – the strategy respectively enters a BUY (break above upper trendline) or SELL (break below lower trendline) order.

Besides entering an order on the breakout (either BUY or SELL) our strategy allows you to configure static and ATR-based take-profits and stop-losses. In this way, you can breakouts as entry and exit points or take-profit and stop-loss as exit points.

What Results Can It Achieve?

This automated trading system will open, close and manage your trades automatically, but we advise that you acquire the following skills below to protect your account against unpredictable market events.

- cBot optimisation.

- Not overfitting with optimisation.

- cBot backtesting.

- Trading system timing - when to turn on or off the cBot.

- Financial market knowledge, when to close trades early and let winners run.

Free Training on Demo Account

We will show you how to optimise settings for any symbol you wish to trade while using the 14-day free trial download and backtest to verify the results and we can also provide information on when to use different types of automated trading strategies.

Learn how to optimise and backtest any symbol, and define your risk vs reward.

How To Optimise Your Settings

This trading system will allow any symbol your broker supports, you will need to find suitable settings yourself, if you need help with doing this via optimisation just follow the link below.

cBot Adjustable Settings

This cBot has any settings and they are all explained below, if there is anything that you do not understand please follow the link below.

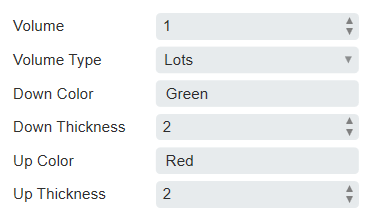

Volume Settings

- Volume

- This parameter allows you to set the units that you’d like to trade, based on the type of volume below. If you select 1 and select Units the strategy will trade one unit of your chosen asset for each trade. If you select 1 and Leverage it will use up all your capital with 1x leverage (i.e. it will trade your entire balance on each trade).

- Volume Type

- This parameter lets you choose Lots, Units or Leverage volume so that your strategy can trade fixed amounts of capital (in units or lots) or proportional to your current available balance.

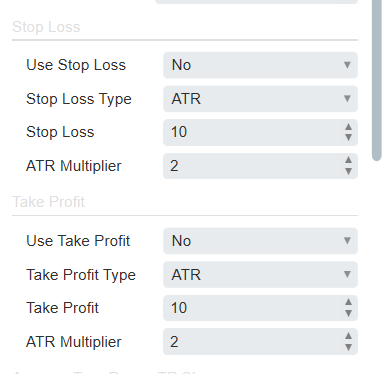

Stop Loss / Take Profit Section

- Use Stop Loss

- You can select between No (no stop loss, exit is defined by breakout reversal), and yes (stop loss deployed)

- Stop Loss Type

- You can select ATR (setting the ATR parameters to your dynamic stop loss below) and fixed (setting a fixed unit stop loss below)

- Stop Loss

- This is the fixed unit stop loss assuming you selected a fixed stop loss.

- ATR multiplier

- This is the multiplier on the ATR (configured below) to use for the ATR configured stop loss. For example, if you select 2.3, an ATR stop loss will be placed 2.3 ATRs wide from the entry price.

- Use Take Profit

- You can select between No (no take profit, exit is defined by breakout reversal), and yes (take profit deployed)

- Take Profit Type

- You can select ATR (setting the ATR parameters to your dynamic take profit below) and fixed (setting a fixed unit take profit below)

- Take Profit

- This is the fixed unit take profit assuming you selected a fixed take profit.

- ATR multiplier

- This is the multiplier on the ATR (configured below) to use for the ATR configured to take profit. For example, if you select 0.9, an ATR takes profit will be placed 0.9 ATRs wide from the entry price.

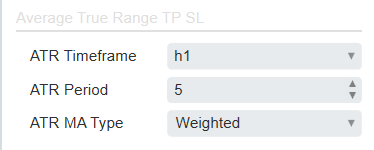

Average True Range TP SL Parameters

- ATR Timeframe

- Here you can set the timeframe for the ATR that is used for both stop loss and take profit. You can use the same timeframe as the asset (i.e. 2 hrs) or a different one.

- ATR Period

- Here you define the lookback period for the ATR for both the ATR-based stop loss and ATR-based take profit.

- ATR MA Type

- Here you define the type of smoothing to be done on the ATR value that is returned to you for use with ATR-based take profit or ATR-based stop loss. If you select Triangularly – you get a triangular MA that is used to smooth the ATR value.

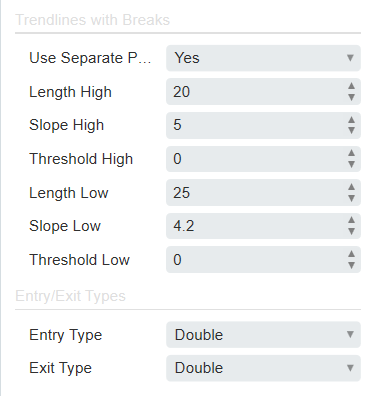

Trendline Section

- UseSeparateParameters

- This is a yes/no field. If selected as yes it uses different parameters for the lower trendline than the upper trendline. To start we recommend you use the same parameters for both.

- Length High

- This is the lookback period that is used to assess the price signals in order to determine the ATR parameters by which the upper (or in the case of the same upper and lower parameters both) trendline(s).

- Slope High

- This is the trendline slope for the upper (or in the case of the same upper and lower parameters both) trendline(s). The higher the number the steeper the slope of trendlines that are drawn.

- Threshold High

- This is a threshold that you can set to avoid false breakouts. It tells the algo to ignore breakouts that don’t include a close price that is threshold price units above the upper trendline (or in the case of the same upper and lower parameters both trendlines).

- Length Low

- This is the lookback period that is used to assess the price signals in order to determine the ATR parameters by which the lower trendline is drawn. It is only used when Use Separate Parameters is yes.

- Slope Low

- This is the trendline slope for the lower trendline The higher the number the steeper the slope of the lower trendline. This is only used when Use Separate Parameters is yes.

- Threshold Low

- This is a threshold that you can set to avoid false breakouts. It tells the algo to ignore breakouts that don’t include a close price that is threshold price units below the lower trendline. It's only used when Use Separate Parameters is yes.

- Entry Type

- This is a parameter where you can select either single or This allows you to enter a trade when the price closes above or below both (double) upper and lower trendline or ONLY when it breaks out above or below one (single) upper OR lower trendline.

- Exit Type

- This is a parameter where you can select either single or double. This allows you to exit a trade when the price closes above or below both (double) upper and power trendlines or ONLY when it breaks out above or below one (single) upper OR lower trendline.

Telegram Notifications

- Send Telegram Notifications

- When set to yes, the Telegram notifications are sent. Telegram notifications are sent when a position is opened or closed and when a signal occurs.

- Bot Token

- The bot token is used for your telegram service.

- Chat ID

- The chat ID is used for your telegram service.

How To Install & Remove

First, make sure you have the cTrader trading platform installed and then unzip the file and double-click on it to automatically install it onto the platform.

Any Questions?

If you have any questions, please first search our product help forum for the answer, if you cannot find it, post a new question.