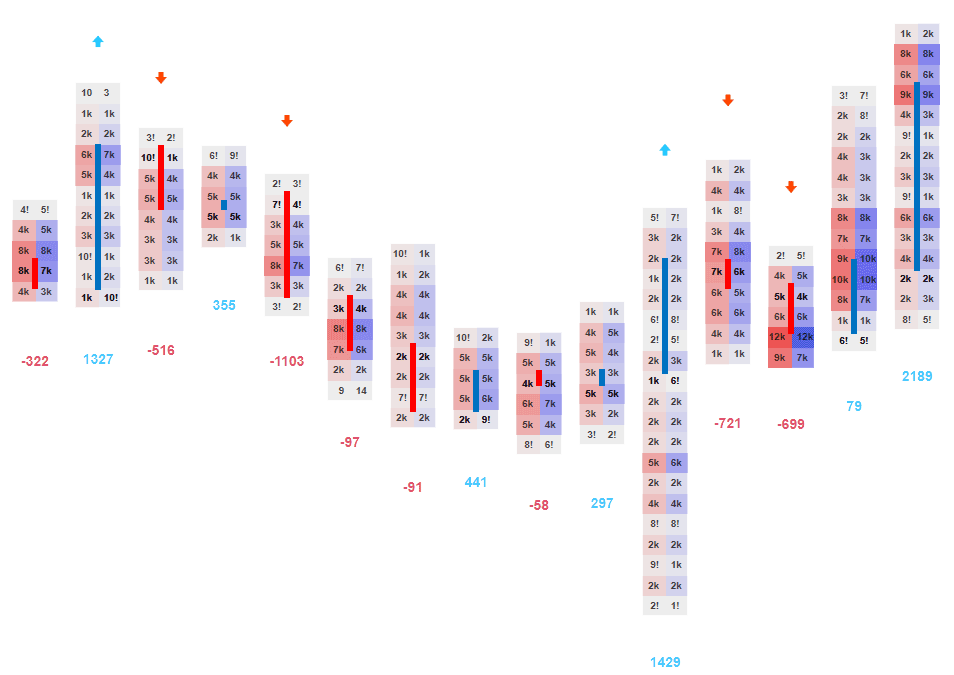

What sets this indicator apart is its ability to display bid-ask imbalances and its comprehensive visualization of how the market's order flow evolves. With this tool, traders can precisely track volume changes and delta variations to understand where significant shifts in market sentiment are occurring, helping them to make better-informed trading decisions. It is important to note that the footprint data presented by this indicator is an approximation rather than an exact representation of the actual volume.

This is because cTrader does not natively offer access to raw, real-time order flow data at the tick level. As such, the Kecia Footprint Orderflow indicator uses available data to estimate volume during tick movements, providing a close approximation of market behaviour but not an exact picture of the actual order volume. Despite this limitation, the indicator performs its best to "understand" the accurate volume during tick formations, enabling traders to make informed decisions based on an educated estimation of market activity.

Video Tutorial

Watch a YouTube video tutorial on how to set up and use the Footprint Order Flow indicator.

Spotting Reversals

- This indicator is ideal for spotting potential reversal points. When a price trend starts to lose momentum, the delta and volume data become crucial for confirming whether a reversal is about to take place. Suppose the delta shifts dramatically from negative to positive (or vice versa), accompanied by a volume spike. In that case, the indicator marks this with arrows, alerting you to a potential shift in market sentiment.

- For example, if the delta shows increasing selling pressure or negative delta values during a bullish trend, it could signal a weakening uptrend and a possible reversal. Conversely, during a downtrend, a spike in buying pressure and a positive delta can indicate the beginning of a bullish reversal.

Identifying Breakouts

- Breakouts are often the result of a significant imbalance between buyers and sellers. The Kecia Footprint Orderflow indicator tracks these imbalances by showing significant delta shifts and volume spikes, especially at key price levels such as support and resistance zones.

- When the delta crosses a specific threshold (set by the user) and there is a surge in volume, it signals that a breakout is likely. The indicator will plot arrows at these levels, providing early warnings of breakout opportunities.

- By combining delta variations and volume analysis, traders can confidently enter trades in the breakout direction, with real-time data confirming the move's strength.

Confirming Trend Strength

- This indicator helps spot reversals and breakouts and can also help confirm the strength of an ongoing trend. If the delta continues to show increasing buying or selling pressure in the direction of the trend, it’s a sign that the trend will continue. This information is critical when deciding whether to hold onto a position or exit early.

- For example, suppose the market is in an uptrend, and the delta shows persistent positive values (buying pressure) with increasing volume. In that case, you can be more confident that the trend will continue. On the other hand, if the delta starts fluctuating or moving in the opposite direction, it might be a sign that the trend is weakening, and a reversal could be imminent.

Volume Analysis for Market Sentiment

- Volume is essential for confirming price moves and understanding the market’s sentiment. The Kecia Footprint Orderflow indicator lets you see where large volumes are concentrated at specific price levels. This data helps identify high-interest zones where significant market participants position their orders.

- For example, if a price moves higher with increasing volume and a positive delta, it signals intense buying pressure and a bullish sentiment. If volume decreases while the price rises, it might signal a weakening trend, suggesting that the price move could soon reverse.

- By analyzing the volume profile and delta in real-time, the indicator allows you to understand how market sentiment is evolving and adjust your strategy accordingly.

Bid-Ask Imbalances for Price Confirmation

- The Kecia Footprint Orderflow indicator also helps identify bid-ask imbalances, a crucial tool for understanding the underlying strength of price movements. These imbalances reveal where there is more buying or selling pressure at specific price levels.

- When the ask (sell orders) outweighs the bid (buy orders), it can indicate that sellers are in control, potentially pushing the price lower. Conversely, buyers are in control when the bid outweighs the ask, and the price may rise. By identifying these imbalances in real-time, you can anticipate price movements before they are fully reflected in the chart, giving you a key advantage in fast-moving markets.

2025 New Feature: Interactive Candle Analysis

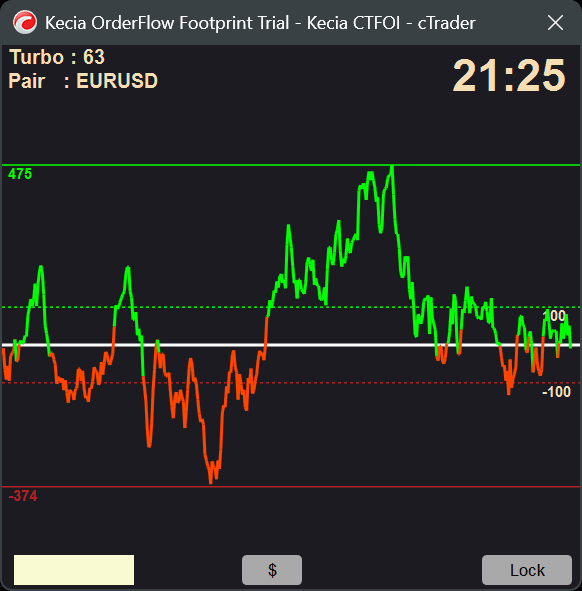

In addition to these practical applications, the Kecia Footprint Orderflow indicator includes an interactive feature that significantly enhances the trader's ability to analyze price action.

Interactive Delta and Volume Analysis

A pop-up window appears when you click on any candle, showing detailed information about how the delta has varied during the candle’s formation. The window will display the maximum and minimum delta values, offering insights into the buying and selling pressure throughout the candle’s life. This helps you understand how momentum shifted during the candle’s formation and whether the price movement was backed by strong order flow or weaker participation.

Volume Vibration Chart

An additional feature within the pop-up window is the “Vibration Chart.” When you press the "$" button, a reference line will be drawn on the chart at the selected price level (after that, press the "p" button). This reference price allows you to visualize how the volume behaves relative to this price point, forming the Volume Vibration Chart.

The vibration chart reveals how volume fluctuates as the price approaches the reference line, helping you understand the concentration of market participants at this price level. This feature is handy for spotting areas of high interest or anticipating price reactions at critical levels. Suppose the volume increases as the price approaches the reference line. In that case, it may signal that traders are becoming more interested in this price level, which could result in significant price action.

Technical Features

The "Lock" button will fix the analysis to the most recent candle, meaning it will automatically update to analyze the last formed candle as new candles are created. To tailor the Kecia Footprint Orderflow indicator to your trading needs, it comes with several customizable settings:

Delta Saturation Value:

The delta saturation value sets a threshold for significant delta imbalances. If the delta exceeds this value, the indicator plots arrows to highlight critical levels, making it easy to spot strong buying or selling pressure. A higher value filters out more minor shifts in the delta, while a lower value shows more sensitive changes in market sentiment.

AlphaPips:

This parameter helps filter the data for display clarity. By adjusting the AlphaPips value, you can control how granular or broad the footprint data appears on the chart. This allows you to zoom in on detailed order flow changes or broaden the data for a higher-level view.

PipsCorrection:

This feature corrects pip calculations, ensuring the indicator displays accurate price levels for your trading asset. When trading instruments with varying pip values, ensuring the footprint correctly aligns with the chart’s price scale is essential.

Volume Correction:

The volume correction adjusts how volume is calculated and displayed, providing more accurate volume data. This feature helps refine the indicator’s volume analysis, accurately reflecting market participation, even in fast-moving or illiquid assets.

Row Height:

The row height determines the size of the footprint rectangles, measured in pips. It’s essential to set this value carefully—too low, and the chart may become cluttered or cause software performance issues. For most trading pairs, the optimal value is typically one pip per rectangle, ensuring clarity without causing performance slowdowns.

How To Install & Remove

First, make sure you have the cTrader trading platform installed. Then, unzip the file and double-click it to install it automatically.

Any Questions?

If you have any questions, please first search our product help forum for the answer; if you cannot find it, post a new question.

Need a Broker

If you are still looking for a trustworthy broker, look at our best cTrader broker site.