The cTrader Moving Average Crossover Strategy is a very commonly used system to help traders find the middle of a trend that defines price action in which prices move in a specific direction over a period. Generally, trends are either upward or downward, as sideways movements are considered consolidation and not trends.

How Do We Capture a Trend?

- Short-term trends can be captured using short-term moving averages.

- Long-term trends can be captured using long-term moving averages.

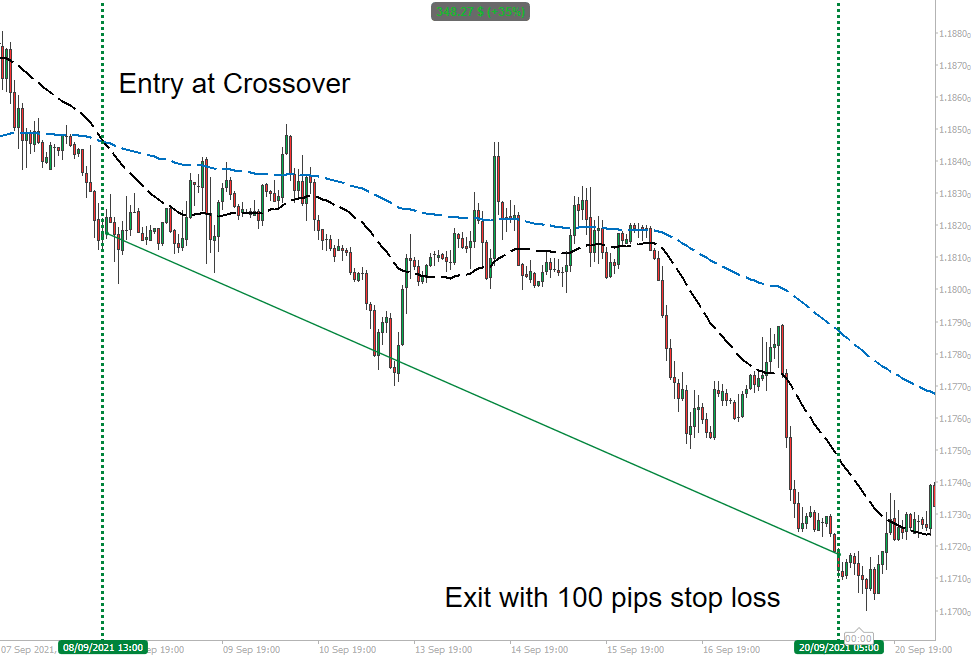

- An example is a 5-day moving average of the EURUSD crosses above the 20-day moving average of the same symbol.

What Is a Fast and Slow Moving Average?

The fast-moving average is a short-term moving average, and the period value must be lower than the slow-moving average period. A moving average, as a single line, is often overlaid on price charts to indicate price trends. A crossover occurs when a faster-moving average crosses the slower-moving average.

What makes this trading system so different is that you can choose the period, type and source for the fast and slow-moving average indicators, which are used to enter and exit the trades.

What Moving Averages Can You Choose?

You can choose eight different types of moving averages for each indicator, so you can mix a simple MA with an exponential MA.

- Simple

- Exponential

- Time-series

- Triangular

- VIDYA

- Weighted

- Wilder smoothing

- Hull

How Does it Work?

It is probably best to explain how this system works, so there is no confusion when you are using the system.

Free Training on Demo Account

We will show you how to optimise settings for any symbol you wish to trade while using the 14-day free trial download and backtest to verify the results and we can also provide information on when to use different types of automated trading strategies.

Learn how to optimise and backtest any symbol, and define your risk vs reward.

What Results Can It Achieve?

It's essential to recognise that no automated trading system can consistently deliver positive results without active oversight. All trading bots, regardless of the strategy, require an experienced trader to monitor performance, adjust parameters, and make informed decisions based on changing market conditions. They are tools to support trading, not replacements for trader expertise.

Read The User Guide

When you first use this trading system, you may need a little help.

Email & PopUp Alerts

If you turn on either the email or the popup alert then when a signal occurs and a position opens you will be informed that this event has occurred, you also have the option to turn off auto-trading and use this just as a signal system.

Instant Telegram Message Alerts

You can configure this trading robot to also send instant Telegram alerts direct to your PC, Tablet or mobile phone.

Trading Hours

This is very important and will vary from symbol to symbol, with XAUUSD there is unpredictable volatility at certain times of the day, for example, heavy trading could happen in the morning or late afternoon, this is why the parameters we use are 09:00 - 13:00 GMT. If trading hours are used then the robot will only open positions during the set hours, but it will continue to manage the trailing stop, take profits and stop losses at all times.

Watch a Video Demonstration

The video has been uploaded to 1080p High Quality, so do not forget to set your U-Tube video quality to 1080p HD.

Duration: 18 minutes - Watch full-screen on YouTube

How To Install & Remove

First, make sure you have the cTrader trading platform installed and then unzip the file and double-click on it to automatically install it onto the platform.

Need Extra Help?

Get instant answers with cTrader Sensei — our free AI assistant built for the cTrader platform. It can explain the indicator settings, suggest trading strategies, and guide you step-by-step through the use of this indicator. Rated 4.9 out of 5 in the ChatGPT Store.

Chat with cTrader Sensei

Prefer human help? Visit our support forum where our team and community can assist you.

Note: cTrader Sensei runs on OpenAI's ChatGPT platform. To use it, you will be asked to create a free OpenAI account. Registration is quick and costs nothing.

The free version works immediately, but upgrading to a ChatGPT Plus subscription unlocks the latest GPT model, which provides more accurate and detailed answers for trading, coding, and product support.

To upgrade, log in to ChatGPT, click your profile in the bottom left corner, and select 'Upgrade to Plus'.

Need a Broker

If you're still looking for a broker with tight spreads and fast execution, visit our top cTrader broker site.